The “Big Four” global accounting firms – PwC, Deloitte, KPMG and Ernst & Young – are the masterminds of multinational tax avoidance, the architects of tax schemes which cost governments and their taxpayers more than $US1 trillion a year.

The Big Four have, under a Rasputin-like cloak of illusion strayed from their original and critical role of verifying the accuracy of financial accounts for all stakeholders, to be “accountants of fortune” merely representing the accounting position for multinationals and developing aggressive international tax avoidance practices,

Although presenting as “the guardians of commerce” they are unregulated and unaccountable; they have infiltrated governments at every level and should be broken up.

This is the view of George Rozvany, Australia’s most published expert on transfer pricing, which is one of the principal ways large corporations pursue cross-border tax avoidance. Rozvany stepped down last year as head of tax in Australia for the world’s biggest insurance company, Allianz. Formerly, he was an insider at Ernst & Young, PwC and Arthur Andersen.

“The Big Four have, under a Rasputin-like cloak of illusion strayed from their original and critical role of verifying the accuracy of financial accounts for all stakeholders, to be “accountants of fortune” merely representing the accounting position for multinationals and developing aggressive international tax avoidance practices,” he told michaelwest.com.au.

Rozvany is writing a series of books on corporate tax ethics. “This is not a victimless crime,” he says. “While Western governments have been cutting back their aid to the most underprivileged in society, from the homeless to orphaned children in Africa, multinational companies have been diverting ever larger profits into tax havens”.

“The global community must also recognise the links between aggressive taxation behaviour, money laundering, corruption, organised crime and terrorism, of which the Brussels bombings and 9/11 are chilling reminders. This, unquestionably, is the financial sewer of humanity where the purpose for such money, no matter how malevolent, is simply hidden until used”, Rozvany says.

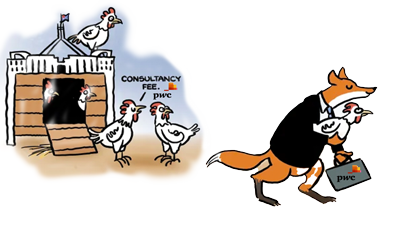

At the heart of the issue is a conflict of interest. While the Big Four advise governments on tax reform, they make lavish fees advising their multinational clients how to avoid paying tax.

“They are both architect and engineer,” says Rozvany. “They sell the (tax avoidance) schemes to the multinationals; and in the case of the LuxLeaks scandal last year, they arranged the deals in secret with government, to the detriment of all other sovereign nations and their taxpayers”.

In the PanamaPapers scandal earlier this year, Panama City law firm Mossack Fonseca was singled out as the major culprit behind a global tax avoidance scam, says Rozvany, but who signs the financial statements for Mossack’s clients? Who is guarding the guards? “And by the way, if one enters a Mossack Fonseca office, one knows that one is entering an aggressive law firm not one pretending to be something else”.

“From a regulatory viewpoint, it makes perfect sense to split the accounting and tax functions of each of the Big Four to improve financial integrity and to split each of these firms again into two firms to create competition. International commerce will then have eight international audit firms and eight international tax firms from which to choose.”

“They have become too big, too big to fail, so they must be broken up

The sheer size and power of the major accounting firms presents a unique dilemma for regulators. Just four entities, housed in opaque partnership structures with joint insurance arrangements, audit 98 per cent of corporations with turnover of $US1 billion or more.

“Their signage adorns the skyline in every major city in the world. They have meticulously manicured their public image. They are spectacularly profitable but beyond the law. They are trusted but not trustworthy. They have become too big, too big to fail, so they must be broken up. Break up is hardly radical. It has been done in many industries including banking, oil and communications”.

This year, the combined income of the Big Four will surpass $US130 billion. They employ more than 800,000 staff worldwide. What a telling metric it is though that KPMG has a Luxembourg office designed for 1,600 staff in a country of just 550,000 people.

“This is the equivalent of a US office with a staff of more than one million,” says George Rozvany.

In support of his thesis of this untenable rise in private power, he points to the string of global tax frauds and scandals which have engulfed the audit firms; from the $US11 billion KPMG tax shelter scandal and the LuxLeaks debacle (which is likely to drag in all four firms) to the more recent PanamaPapers imbroglio.

All four major audit firms were approached for comment for this story. All four declined the opportunity to discuss the Rozvany claims in person. Detailed questions were also put by email but these too were declined.

PROBLEM IDENTIFIED BUT PERPETRATORS STILL AT LARGE

Over the past four years, rising community awareness has made multinational tax avoidance a big political issue. In Australia, press revelations about the tax affairs of Google, Apple, eBay, Uber, News Corp, Chevron, Glencore and the pharmaceutical giants, among many others, led to the establishment of the Senate Inquiry into Corporate Tax Avoidance.

The upshot has been increased scrutiny of the tax affairs of multinationals, targeted investigations into some of the major culprits and finally reform. In Australia, that reform came in the guise of last year’s amendments to the Tax Act requiring better disclosure by both wealthy private companies and multinationals.

Yet still the spotlight has barely fallen on the main facilitators.

Although, on two separate occasions, two representatives from each of the Big Four firms appeared before the Senate Inquiry to explain their involvement in aggressive tax planning, and although their performance under examination was unconvincing, coverage in mainstream media was scant.

They claimed to be in support of transparency, as this was important to building public trust in the accounting profession. When asked however about the accounting practices of their multinational clients during the November 2015 hearings in Sydney, the Big Four representatives were far from transparent.

Asked why at least twenty of their top multinational clients had switched from general purpose accounts to special purpose accounts, resulting in fewer financial disclosures and lower transparency, they could not answer. They were tax partners, they said, not audit partners.

The multinationals who had switched to the less transparent (special purpose) regime, included Bupa Australia (KPMG), News Australia (EY), JBS Holdco Australia (KPMG), Serco Australia (Deloitte) and Johnson & Johnson (PWC).

As Inquiry observer and University of NSW accounting expert Jeffrey Knapp described it, the assurances of the Big Four on accountability and transparency are not matched by their actions.

“Whereas general purpose accounts comply with disclosure requirements across 40 plus accounting standards, special purpose accounts follow as few as five standards. Special purpose accounts also allow multinationals to avoid audited disclosures of transactions and balances with related parties in foreign jurisdictions including tax havens,” says Knapp.

When asked by this reporter before the Inquiry why their clients were switching en masse to a regime of lower transparency, the audit firms declined to respond.

“The archaic partnership structure is the issue … transparency and accountability”

The Big Four all have their antecedents in mid-19th century England and grew by merging and taking over smaller firms. By the 1970s, they had become the Big Eight. When Arthur Andersen collapsed amid the Enron scandal in 2002, the Big Five became four.

The individual country partnerships are now similar to a MacDonald’s franchise where they own the local store but owe certain obligations to the franchisor.

“In both cases the brand name carries cache. The difference is that at MacDonald’s the customer gets the same burger every time but, with the Big Four, the customers may get a Lehman Brothers’ burger, or an Enron, WorldCom or AIG burger,” says George Rozvany.

That they have not listed on the share market is telling. Rozvany estimates that, on typical share market earnings valuations, the Big Four are conservatively worth $US100 billion to $150 billion apiece in a public float.

Although the allure of such a lucrative payday for the partners in each firm must be great, the fear of transparency which would come from a public listing may well be greater. It is the desire for secrecy, he says, which keeps them as partnerships.

‘Like the Mafia, the Big Four operate with a six-level hierarchy: Partner, Director, Senior Manager, Manager, Senior Associate and Associate,” says Rozvany.

“Compare this with major international law firms whose hierarchy in the provision of advice is three or four levels. And risk is more easily controlled”.

As is also the case with mafia, loyalty and tribalism also have been key factors in the growth and preservation of the business. When it comes to branding however, the accounting firms are without peer.

“They have an incredible track record in managing reputation,” he says. Much of this comes down to the slew of surveys and expert reports conducted by their consulting divisions, reports on everything from government policy and the economy to women in the workforce and cyber security. They regularly act too as independent monitors in regulatory matters and their staff flow constantly in and out of government agencies via secondment programs.

When the Australian Tax Office made thousands redundant in recent years, many went to the Big Four. The gamekeepers had turned poachers. Worldwide, the “revolving doors” between the Big Four, Revenue Authorities, corporate regulators and other government departments delivers pervasive influence and render it harder for government agencies to prosecute wrongdoing.

Rozvany is fast to defend the individuals who work in the major firms, many of whom are former colleagues. It is the system which needs fixing, he says. The very success of the accounting oligopoly is the failure of governments. And the partnership structure of the firms is problematic, he says. There is no viable corporate governance in the partnership structure, nor any penalty regime, to prevent rogue partners from engaging in unethical and illegal activities.

“So powerful are the Big Four, they cause the tax laws of sovereign nations to change”

“The archaic partnership structure is the biggest issue. In public companies there is a direct line of reporting, with a CEO reporting to the board. Every position in a public company is accountable to shareholders. There is transparency and accountability, and pain of dismissal.

This is not the case for the Big Four.

In late 2014 the LuxLeaks scandal hit the news after whistleblower Antoine Deltour leaked hundreds of PwC private tax rulings. The firm had secretly sought and won these “binding rulings” from the Grand Duchy of Luxembourg.

The effect was that hundreds of the firm’s multinational clients had diverted billions of dollars to a tax haven. Only PwC documents were leaked though it is thought all four firms are implicated in the scandal.

As noted by the International Consortium of Investigative Journalists (ICIJ) who broke the story, in 2012, US corporations with Luxembourg entities paid tax of only $US1.04 billion on net profits of $US95 billion. The large licks of tax which were due other sovereign nations had transformed into a small amount of tax for one small nation.

“So commercially powerful are the Big Four,” says Rozvany, “That they cause the tax laws of sovereign nations to change with the promise of additional revenue”.

What is the difference between Mossack Fonseca and the Big Four, asks Rozvany. The former orchestrates tax schemes for wealthy Western businesspeople and multinationals, as do the latter. The Panamanian law firm funnels profits through complex structures to tax havens such as the British Virgin Islands, so do the Big Four.

“They have presided over a string of the world’s biggest and most costly scandals for which no partner has ever been held criminally accountable”.

The KPMG tax shelter scandal in 2005 was then the largest tax fraud in history, translating to $US15 billion – $US18 billion in today’s dollars. More than $11 billion in falsified tax losses were identified. Those responsible however avoided a full prosecution as the firm did a settlement with the Justice Department.

“The US is the only country to have acted against the big audit firms (prosecution of Arthur Andersen and KPMG). But as a result of punishing Arthur Andersen, the firm disappeared and the others have become bigger and stronger.”

While George Rozvany is the first insider to go public in Australia criticising the power of the Big Four, in Europe, the US and the UK there has been growing recognition of the need to hold the main perpetrators to account.

As Nicholas Shaxson, author of “Treasure Islands”, the bestselling work on tax havens, told us over the weekend, “Like the too-big-to-fail banks, they pose multiple threats to our societies”.

“The Big Four are too influential, in too many countries, in too many parts of the economy. They help their clients exploit loopholes in the law, they milk multiple conflicts of interest, and they lobby governments relentlessly. The wealth they obtain for themselves and for their clients is extracted from the rest of us.”

The Big Four all have their antecedents in mid-19th century England and grew by merging and taking over smaller firms. By the 1970s, they had become the Big Eight. When Arthur Andersen collapsed amid the Enron scandal in 2002, the Big Five became four.

The individual country partnerships are now similar to a MacDonald’s franchise where they own the local store but owe certain obligations to the franchisor.

“In both cases the brand name carries cache. The difference is that at MacDonald’s the customer gets the same burger every time but, with the Big Four, the customers may get a Lehman Brothers’ burger, or an Enron, WorldCom or AIG burger,” says George Rozvany.

That they have not listed on the share market is telling. Rozvany estimates that, on typical share market earnings valuations, the Big Four are conservatively worth $US100 billion to $150 billion apiece in a public float.

Although the allure of such a lucrative payday for the partners in each firm must be great, the fear of transparency which would come from a public listing may well be greater. It is the desire for secrecy, he says, which keeps them as partnerships.

‘Like the Mafia, the Big Four operate with a six-level hierarchy: Partner, Director, Senior Manager, Manager, Senior Associate and Associate,” says Rozvany.

“Compare this with major international law firms whose hierarchy in the provision of advice is three or four levels. And risk is more easily controlled”.

As is also the case with mafia, loyalty and tribalism also have been key factors in the growth and preservation of the business. When it comes to branding however, the accounting firms are without peer.

“They have an incredible track record in managing reputation,” he says. Much of this comes down to the slew of surveys and expert reports conducted by their consulting divisions, reports on everything from government policy and the economy to women in the workforce and cyber security. They regularly act too as independent monitors in regulatory matters and their staff flow constantly in and out of government agencies via secondment programs.

When the Australian Tax Office made thousands redundant in recent years, many went to the Big Four. The gamekeepers had turned poachers. Worldwide, the “revolving doors” between the Big Four, Revenue Authorities, corporate regulators and other government departments delivers pervasive influence and render it harder for government agencies to prosecute wrongdoing.

Rozvany is fast to defend the individuals who work in the major firms, many of whom are former colleagues. It is the system which needs fixing, he says. The very success of the accounting oligopoly is the failure of governments. And the partnership structure of the firms is problematic, he says. There is no viable corporate governance in the partnership structure, nor any penalty regime, to prevent rogue partners from engaging in unethical and illegal activities.

“So powerful are the Big Four, they cause the tax laws of sovereign nations to change”

“The archaic partnership structure is the biggest issue. In public companies there is a direct line of reporting, with a CEO reporting to the board. Every position in a public company is accountable to shareholders. There is transparency and accountability, and pain of dismissal.

This is not the case for the Big Four.

In late 2014 the LuxLeaks scandal hit the news after whistleblower Antoine Deltour leaked hundreds of PwC private tax rulings. The firm had secretly sought and won these “binding rulings” from the Grand Duchy of Luxembourg.

The effect was that hundreds of the firm’s multinational clients had diverted billions of dollars to a tax haven. Only PwC documents were leaked though it is thought all four firms are implicated in the scandal.

As noted by the International Consortium of Investigative Journalists (ICIJ) who broke the story, in 2012, US corporations with Luxembourg entities paid tax of only $US1.04 billion on net profits of $US95 billion. The large licks of tax which were due other sovereign nations had transformed into a small amount of tax for one small nation.

“So commercially powerful are the Big Four,” says Rozvany, “That they cause the tax laws of sovereign nations to change with the promise of additional revenue”.

What is the difference between Mossack Fonseca and the Big Four, asks Rozvany. The former orchestrates tax schemes for wealthy Western businesspeople and multinationals, as do the latter. The Panamanian law firm funnels profits through complex structures to tax havens such as the British Virgin Islands, so do the Big Four.

“They have presided over a string of the world’s biggest and most costly scandals for which no partner has ever been held criminally accountable”.

The KPMG tax shelter scandal in 2005 was then the largest tax fraud in history, translating to $US15 billion – $US18 billion in today’s dollars. More than $11 billion in falsified tax losses were identified. Those responsible however avoided a full prosecution as the firm did a settlement with the Justice Department.

“The US is the only country to have acted against the big audit firms (prosecution of Arthur Andersen and KPMG). But as a result of punishing Arthur Andersen, the firm disappeared and the others have become bigger and stronger.”

While George Rozvany is the first insider to go public in Australia criticising the power of the Big Four, in Europe, the US and the UK there has been growing recognition of the need to hold the main perpetrators to account.

As Nicholas Shaxson, author of “Treasure Islands”, the bestselling work on tax havens, told us over the weekend, “Like the too-big-to-fail banks, they pose multiple threats to our societies”.

“The Big Four are too influential, in too many countries, in too many parts of the economy. They help their clients exploit loopholes in the law, they milk multiple conflicts of interest, and they lobby governments relentlessly. The wealth they obtain for themselves and for their clients is extracted from the rest of us.”

A PROBLEM OF IMMENSE SCALE

The scale of corporation tax avoidance is breathtaking. Related party transactions – that is, companies doing deals between their own entities (many of which are tax driven) – make up more than half of all international trade.

The World Trade Organisation estimates global exports of $US50,000 billion in 2013 which indicates international related party transactions now run in excess of $US30,000 billion, says George Rozvany.

Assuming only five or ten per cent of these transactions are the subject of aggressive transfer pricing practices (which would appear to be conservative if LuxLeaks is a guide) the amount of money at play is in the trillions.

Rack that up against the global foreign development aid budget in 2013 of $US135 billion and the result is “a crushing indictment of Western governments and those who peddle tax avoidance schemes globally”.

Rozvany believes the Big Four, by their very success, “have already sown the seeds of their own destruction” and, such is their power and pervasive presence, there is no option for governments but a break-up.

The evidence of predatory practices is in. As Essex University Professor of Accounting, Prem Sikka, put it in an oped in The Guardian, “They create sham transactions, phoney losses and phantom assets to enable their clients to dodge taxes”. Yet no accountancy firm has ever been disciplined by any professional accountancy body. Same deal in Australia.

As governments have splashed millions to combat predatory schemes, they have never sought to recover a cent from the scheme promoters; continuing to hand them highly lucrative taxpayer funded contracts instead.

This article was originally published by Michael West Media in 2016

Will Labor’s crackdown on the big 3.5 go the way of previous re-regulatory moments?

The government has promised a crackdown on audit and consulting firms — but only after consultation. Will that be where it's all watered down?

Then the headlines come to an end, the public and the media move on, and the industry gets to work watering down the additional regulations, extracting more favours from politicians, warning of the terrible unintended consequences of a harder line on them, and exploiting external events to argue that things really weren’t so bad before.

Think banking at the Commonwealth level. Think gambling in Victoria and NSW.

Will the same cycle play out in government auditing, tax planning and consulting? It’s another poorly regulated, politically connected industry dominated by four large corporations (well, the big four is now the big 3.5 in Australia) beset by scandal after scandal, with executives humiliated before senate inquiries and reluctant regulators under fire for their failures. And yesterday arrived the crackdown, the “re-regulatory moment”, with the government’s economic and finance ministers and attorney-general announcing a suite of measures to significantly increase penalties, bolster regulators and lift the veil a little on the secretive world of tax relations between companies and the tax office.

Labor’s package is a comprehensive one, led by a mammoth and welcome rise in the maximum penalties for advisers and firms promoting tax exploitation schemes from a mere $7.8 million to $780 million, and expanding the laws around tax exploitation schemes to make them easier to prosecute.

It will also develop a package of measures aiming to increase the paltry range of sanctions available to the Tax Practitioners Board, update laws on the kinds of complex tax avoidance schemes now promoted, “clamp down on systemic abuse of our tax system perpetrated by tax agents and other bad actors”, curb the use of legal professional privilege to obstruct investigations, examine whether regulation of consulting firms is needed, increase the tax office’s information-gathering powers and ability to work with law enforcement, review the use of confidentiality arrangements across the whole Commonwealth and strengthen handling of conflict of interest, and increase the visibility of cases where consultants and auditors have lost contracts.

But that package will be developed based on consultation with the industry and agencies “to ensure options are targeted and effective”. The consultation will begin in the coming months (watch out for contracts for consultants to help with the consultation with consulting firms).

That consultation will be where the big 3.5 will get to work trying to undermine the crackdown, explaining the unintended consequences, warning of lost jobs, detailing the unworkability and impracticality, and pushing to reduce the resulting legislation, regulations and changes to documents like the Commonwealth Procurement Rules as much as possible.

On some proposals, government agencies and the big 3.5 will have directly opposite interests. In others, they’ll be aligned. Neither government departments nor consulting firms want to see any reduction in their ability to use commercial confidentiality as a means of reducing scrutiny by parliament, the media and the public. Nor will agencies be very interested in seeing stricter rules around conflict of interest management, especially if it restricts their flexibility in using the same firms and consultants over and over.

Treasury and Finance, and Jim Chalmers and Katy Gallagher, thus have their work come out for them if they’re to avoid looking like Josh Frydenberg abandoning vast swathes of the banking royal commission recommendations, or Daniel Andrews in Victoria and Chris Minns and the Independent Casino Commission in NSW looking after Crown and Star (not to mention, in Minns’ case, the pokies lobby).

If implemented, the suite of measures will be a strong response to the persistent poor behaviour across PwC, KPMG, Deloitte and EY. But there’s one crucial feature missing. The ultimate conflict of interest for three of those firms is that they provide consulting services to government while their tax planning arms advise large corporations on how to starve governments of revenue by avoiding and in some cases evading tax.

No firm that plays an active role in advising corporations on avoiding Australian tax should be able to work for the Australian government. It’s a conflict of interest that can never be managed away. PwC has dealt with that conflict by giving away its consulting arm. The remaining big three continue to benefit from taxpayer money that they try their damnedest to reduce through their work with tax-dodging multinationals.

Now fixing that would make for some interesting consultations.

Should consulting firms be allowed to advise both government and tax-avoiding corporations?

This article by Bernard Keane was 1st published in Crikey