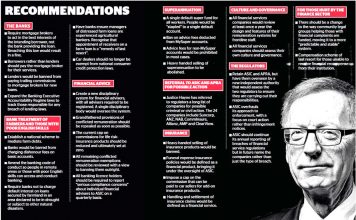

Can APRA and ASIC lift their game?

Doubts have been raised whether the nation’s two peak financial regulators will be able to sharply lift their efforts after the banking royal commission recommended they take more strong-arm action while facing extra oversight from an independent authority.

Both the Australian Prudential Regulation Authority and the Australian Securities and Investments Commission faced criticism from commissioner Kenneth Hayne in his 1000-page examination of the financial sector.

Despite finding laws covering finance had not been ‘‘enforced effectively’’, Justice Hayne proposed the two remain but with a renewed focus on litigation while working more closely with each other.

John Hewson, former Liberal Party leader and now with the ANU’s Crawford School of Public Policy, said Justice Hayne was putting a lot of faith in both agencies to change their long-held behaviour.

‘‘All of the issues examined by the royal commissioner happened on the watch of APRA and ASIC, and now it wants to give them more powers and to take a tougher line against the sector,’’ he said.

‘‘You could just see some people locked up, harsh words said, and then we’ll end up going back to the bad old days.’’

ASIC has already signalled it will take a tougher line on litigation after Justice Hayne criticised the agency for its use of enforceable undertakings.

Dr Hewson said the proposal for a new independent authority to oversee both APRA and ASIC may also fail to deliver substantial benefits to consumers.

The overall changes proposed by the commission fell far short of proper reform for an entire sector so important to the national economy.

‘‘They could have gone for a bold, big sky approach to look at where the sector fits but instead it’s just a series of modest proposals,’’ he said.

Former head of the ACCC, Graeme Samuel, has been appointed by the government to carry out a capability review of APRA that will determine if the regulator has any resource or capability gaps.

Mr Samuel would not be drawn on any details about his review but noted he had few troubles with the current delineation between APRA’s role in the finance sector and that of ASIC.

‘‘I like the current system. You have APRA overseeing the culture and the governance of the system, and you have ASIC acting as the

regulator and taking action where there is misconduct and failures of governance and culture,’’ he said.

Top regulatory expert Professor Dimity Kingsford Smith said ASIC would face an ‘‘existential crisis’’ and could be stripped of its powers if it did not show some teeth after being given fresh funding and new powers.

Professor Kingsford Smith, the director of the University of NSW Centre for Law, Markets and Regulation also said there could be a danger that some of the alleged offending identified by the royal commission could fall outside the statute of limitations.

Professor Kingsford Smith, the director of the University of NSW Centre for Law, Markets and Regulation also said there could be a danger that some of the alleged offending identified by the royal commission could fall outside the statute of limitations.

Professor Kingsford Smith also said there may be some difficulties for ASIC in pursuing some of the potentially criminal cases referred by Justice Hayne.

‘‘In these financial institutions, people tend to make decisions in committees that means it’s very hard to know who had what intention and those matters are not minuted; they don’t minute that kind of thing,’’ he said.

Apart from the review of APRA, the government will follow through with Justice Hayne’s recommendation to create a new independent authority that will oversee the two key financial regulators.

Headed by a panel of three, the new regulatory body will assess the performance of APRA and ASIC, their effectiveness and how they are meeting their statutory requirements.

Justice Hayne said the agency should be able to conduct its own inspections of the regulators ‘‘at will’’ and have the power to demand documents or any information from either of them.

Rating’s agency Moody’s believes the extra powers proposed by Justice Hayne for ASIC plus the oversight authority will see more legal action across the financial sector.

‘‘Moody’s expects this will result in a more litigious regulatory regime and further expects that civil and criminal proceedings may well emerge as a result of evidence brought to light during the commission’s proceedings,’’ it said in a note to investors.

The government will follow through with the new regulator that will report to the Parliament twice a year.

This authority will replace, in part, the Financial Sector Advisory Council, which was created by then treasurer Scott Morrison and then financial services minister Kelly O’Dwyer in response to the Financial Services Inquiry.

Established in 2016, it was headed by Suncorp managing director Michael Cameron and included Westpac chief executive Brian Hartzer and former AMP chief executive, Craig Meller, who resigned from the council in April last year.

Article originally publish in SMH 6 Feb 2019

ADELE FERGUSON. The regulators failed bank customers but they are now being trusted to fix this mess. (SMH 5.2.2019)

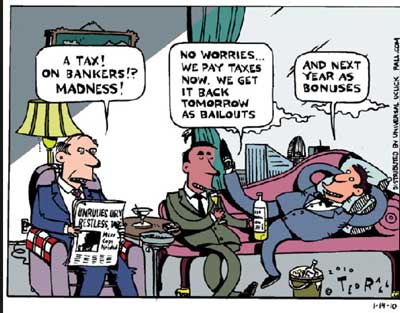

For those Australians hoping for structural separation of the banks, an overhaul of the regulators or heads on sticks, royal commissioner Kenneth Hayne’s verdict would have been disappointing.

For those looking for massive structural change in the wake of the Banking Royal Commission, an overhaul of the regulators or a list of heads on sticks, Commissioner Hayne’s verdict may have disappointed, says Adele Ferguson.

There was little blood and gore. It was more like a soft landing.

The royal commission spent a year listening to how many ways government regulators failed in their duty to regulate the financial services industry.

Customers were ripped off but the regulators had little or no appetite to use the tools at their disposal, preferring instead to do cosy deals with those they were meant to police.

Despite this, Hayne is giving them more powers and more work and has faith they will now actually do their job.

He recommends additional co-regulation, which could be an excuse for more buck-passing.

In the case of the Australian Securities and Investments Commission (ASIC), there are some new commissioners who hopefully will start flexing their muscles, but the Australian Prudential Regulation Authority (APRA) has kept the same old faces.

Hayne throws the book at some of the country’s biggest institutions including the National Australia Bank, Commonwealth Bank, ANZ, AMP and Suncorp for an array of crimes.

There are 24 cases all up, which could end up including individuals. But Hayne has referred the cases to ASIC or APRA for further investigation in the hope that this time they will do something.

The former High Court justice lays into NAB’s chief executive Andrew Thorburn and chairman Ken Henry, noting he was not convinced the pair had learnt the lessons of misconduct.

In other words, Hayne is not persuaded that NAB is willing to accept the necessary responsibility for deciding what is the right thing to do and then have its staff act accordingly. It is a withering summation that should give both cause to consider their future.

The royal commission tackled mortgage broking, financial advice and the $44 billion life insurance industry – to a degree – and recommends insurance contracts should be included in existing unfair contract term provisions to help protect customers from life insurers who fail to update medical definitions and other hidden nasties.

But he leaves it up to ASIC to decide whether to ban commissions on life insurance.

Treasurer Josh Frydenberg delivers the government’s response to the findings of the Banking Royal Commission. Live from 4 pm direct from Parliament House in Canberra.

Under the former Labor government’s Future of Financial Advice legislation, which banned commissions on financial products, life insurance was carved out.

It means trailing commissions and upfront commissions remain in force. Time will tell what ASIC does.

Ditto for superannuation trustees. One of the biggest eye-openers of the royal commission was the failure of trustees – largely in retail funds – to act in the best interests of members.

In many cases they allowed members to be charged fees for no service or put them into life insurance products that were not commercial.

Anything more radical such as phasing out for-profit retail super funds isn’t touched.

Equally shocking, ASIC chased remediation instead of simultaneously hitting them with breaches and fines.

Hayne has recommended that trustees of super funds should be more heavily scrutinised – as they should – but largely leaves it up to ASIC and APRA to ensure they do the right thing.

Anything more radical such as phasing out for-profit retail super funds isn’t touched.

In a bid to improve APRA, Hayne has called for a capability review into its performance, culture and structure – something that was recommended by David Murray in his December 2014 report into the financial system.

The government has nominated the highly regarded Graeme Samuel to conduct this review.

Every four years both ASIC and APRA will be subject to a fresh capability review.

This is a positive. But at the end of the day, it will depend on whether the recommendations are adopted.

ASIC had a capability review that was released in 2016 but the government largely ignored them.

Given the disappointing behaviour of regulators over the years, including allowing the regulated to preview and change draft press releases and in the case of CommInsure, slugging its parent CBA with a community benefit donation of $300,000 instead of an $8 million fine, Hayne recommends an overseer of the regulators.

The commissioner has put a lot of faith in the regulators to do their job but unless ASIC and APRA change their ways, little else will change.

From this point on, the devil will be in the detail. If history is any guide, lobbyists will be out in full force from today trying to get both sides of politics to make as few changes as possible.

- Adele Ferguson comments on companies, markets and the economy