Bank leadership clearout

Leadership

Spill

The current executives and boards of the nation’s banks are not the right people to repair the financial industry’s damaged culture, says Graeme Samuel, who is about to embark on a sweeping review of the banking watchdog in response to the royal commission.

On the day of the shock resignations of National Australia Bank chairman Ken Henry and chief executive Andrew Thorburn this week, Mr Samuel said banks could change their culture – a key focus of the royal commission – but it would be a near-impossible task for incumbent management.

“Banks can change their own culture, subject to an acceptance at the top that culture needs to change,” he said.

“Invariably it is very difficult for those that were responsible for the culture and the practices of the past to change their tone in the future,” Mr Samuel said.

“It’s often said that when a corporation runs into difficulties it’s hard to get the past management to undertake a restructure because it involves an implicit acceptance by them that the structure they put in place is wrong,” said Mr Samuel, a former head of the Australian Competition and Consumer Commission (ACCC).

Opposition Leader Bill Shorten also ramped up the pressure on banks on Friday, saying there had been “a little sigh of disappointment” at the Hayne royal commission’s final report.

Asked if other bank leaders should also resign, Mr Shorten said banks “somehow seem to think that community attitudes don’t apply to them.”

“I think if no one out of the banks goes to jail, if no one gets prosecuted or charged, I think Australians would say there’s been a cover-up,” Mr Shorten said.

Treasurer Josh Frydenberg said: “The government has been clear. The misconduct must end and the interests of consumers must come first.

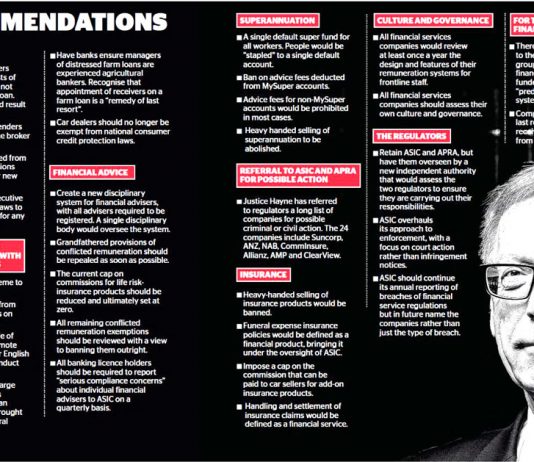

“The government is committed to making this happen. That’s why we’re taking action on all 76 of commissioner Hayne’s recommendations including supervision of culture, governance and remuneration.

“We are putting in place the legislative framework which provides the regulators with the powers and resources to hold those who abuse our trust to account.

“If nothing else, the public is entitled to expect that the law is applied and enforced.”

NAB shares dropped 0.7 per cent on Friday as it faced market pressure to look outside its own ranks for a new chief executive to replace Andrew Thorburn, with several banking experts saying an outsider was needed to improve the bank’s troubled culture.

“We would hope the board will consider a broad range of candidates, with the potential for an external hire to take a fresh look at the culture of the organisation,” JP Morgan’s banking analyst Andrew Triggs wrote.

Such a move by the board would mean overlooking former NSW premier Mike Baird, a NAB executive and seen as the leading internal candidate to lead the bank, though others in the market believe Mr Baird would be a strong choice because of his political skills.

Potential external candidates who could succeed Mr Thorburn include Medibank Private chief Craig Drummond, RBS CEO and former Commonwealth Bank executive Ross McEwan, of NAB’s acting chief Phil Chronican, bank anlaysts said.

Mr Samuel’s comment highlights the potential challenge facing all the major banks in bringing about cultural change, given their leaders were all long-serving members of the local banking industry.

Commonwealth Bank chief executive Matt Comyn has been with the bank for about two decades, Westpac Brian Hartzer has been a senior executive at the bank since 2012, and worked at ANZ in the early 2000s, while ANZ chief Shayne Elliott has been at the bank since 2009, with decades in the industry.

NAB has appointed a long-standing former executive Mr Chronican as acting chief executive from next month. Mr Chronican on Friday spoke with the top 300 managers within the bank, backing the bank’s previous strategy under Mr Thorburn, and highlighting a previous critical “self-assessment” that said the board had failed to ask enough tough questions of management.

NAB has appointed a long-standing former executive Mr Chronican as acting chief executive from next month. Mr Chronican on Friday spoke with the top 300 managers within the bank, backing the bank’s previous strategy under Mr Thorburn, and highlighting a previous critical “self-assessment” that said the board had failed to ask enough tough questions of management.

Mr Thorburn and Dr Henry faced pressure from political leaders this week, after blistering criticism from the banking royal commissioner Kenneth Hayne, who said he was “not as confident as I would wish to be that the lessons of the past have been learned.”

When Prime Minister Scott Morrison was asked on Friday about Dr Henry’s departure, he said: “Well, I said the other day that the Royal Commissioner had some fairly sharp assessments to make, and that people would reflect on those, and they have.”

Dr Henry also flagged a period of board “renewal” among NAB’s directors when he resigned this week.

Governance expert Vas Kolesnikoff, head of research at Institutional Shareholder Services, highlighted that some NAB directors had served for several years, and pointed to the need for boards to take “collective accountability.”

“There’s got to be some responsibility there on other directors as well,” Mr Kolesnikoff.

Mr Samuel, himself a former investment banker, was this week appointed to run a capability of the Australian Prudential Regulation Authority (APRA), which came under fire at the royal commission for its failure to take legal action against super funds and banks.

Mr Samuel was also one of three experts tasked by the bank regulator with a painstaking and granular report on the governance and cultural problems inside the scandal-plagued Commonwealth Bank.

Article originally published in the SMH