Electoral Pork Barreling

Treasury calls bullshit on company tax cuts, wages growth

Glenn Dyer and Bernard Keane write in CrikeyIt’s a speech Treasury secretary Steven Kennedy wouldn’t have dared give under the previous government — and...

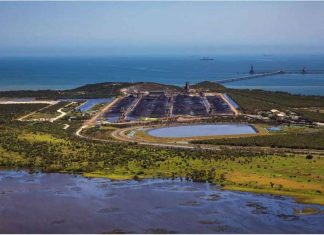

Adani – Interactive cost, environmental impacts, jobs and the future

Interactive: Everything you need to know about Adani – from cost, environmental impact and jobs to its possible future

ABC News: Nationwide, a majority of voters...

Revealed: the extent of job-swapping between public servants and fossil fuel...

This was the same firm that Robb had publicly defended when it controversially acquired a 99-year lease for the Port of Darwin in 2015.

Two...

The ‘great Australian silence’ 50 years on

The 'great Australian silence' 50 years on

Detail from Julie Shiels’ 1954 poster White on black: The annihilation of Aboriginal people and their culture cannot...

Australia’s dirty secret and the trial too sensitive for an open...

Scott Morrison has stated he wants to govern in the “Howard tradition”, but sadly that has also entailed adopting the worst of John Howard’s...

A Parliamentary Democracy for Everybody

Forget what politicians say.

What truly matters is what they do.

And what they do is vote, to write our laws which affect us all.

A Parliamentary...

‘‘Stand up and be counted’’ Kerry O’Brien

ABC warrior Kerry O’Brien has staged an intervention in the federal election and declared war on the Institute of Public Affairs at the same...

🌟 Stay in the Loop with a Twist!

Crave more than just the run-of-the-mill news? Dive into the audacious and razor-sharp commentary at Pigsfly Newspaper! Click your way to spectacle and insight—make sure to hit the like button and follow us on Facebook Pigsflynewspaper. Ready for news that packs a punch? Visit us at Pigsfly Newspaper and never miss a beat. Because why just read the news when you can experience it? Let’s make waves together! 🚀