Risks are greater than I can recall in my working life

Despite the encouraging “maths” in this budget, the return to surplus has still yet to be delivered writes John Hewson.

Despite the encouraging “maths” in this budget, the return to surplus has still yet to be delivered writes John Hewson.

Budgets are about choices. With an unexpected surge in revenue, the government’s main options were to apply it to deficit repair, to spend it, or to give it back in tax cuts, or some combinations thereof.

The government’s base motive was political, to set the agenda for an election-winning strategy, with an election possibly as early as August/ September this year.

The major challenge was its political standing, with the Abbott/Turnbull governments having lost more than 60 Newspolls. Moreover, expecting the Labor opposition to at least match any tax cuts, and to accept necessary spending initiatives, and likely to attempt to define itself as “more fiscally conservative/responsible” , the government couldn’t risk promising too much. Yet, it did need to promise some tax relief, especially to the Labor heartland, and some increased spending to traditional Coalition supporters, and to hopefully underwrite growth, while attempting to reset key benchmarks of fiscal responsibility.

Someone obviously sat there checking off a list of key constituencies/ interests – the speech degenerated into a box-ticking exercise. Hence, the modest, targeted, tax cuts, the spending on health, the aged, national security, and infrastructure, and the tax/GDP commitment while still promising a surplus one year earlier than foreshadowed.

But all this hangs and, I would warn, precariously, on the sudden revenue surge being sustained, and on the assumed strength of the global and national economies. I have little confidence on both fronts.

The risks (economic and geo-political) and unpredictability of the global outlook are greater than I can recall over my working life. Recent data question whether there is a sustainable, synchronised, economic recovery; bubbles are real in stock, bond and property markets, and exchange rates are misaligned, all possibly facing a correction; central banks have bloated balance sheets, and seem powerless to disengage from low interest rates; global debt is some $US165 trillion ($221 trillion), and some 40 per cent higher than at the global financial crisis.

Domestically, while our economy is transitioning from the resources boom, with growth picking up a little, it is most unlikely to perform as assumed in this budget, with overall growth somewhat weaker as households struggle with the costs of living, their wages flatlining, excessive debt and falling house prices. Again, despite the encouraging “maths” in this budget, the return to surplus has (again) been assumed, and still yet to be delivered.

The figuring is also helped by the new-found practice – that makes the cash balance look better than it would have previously – of moving infrastructure projects “off balance sheet”, by treating them as “commercial ventures”, even though any full, cost/ benefit analysis would probably suggest that they would never be commercially viable. So it is easy to build an attractive list and ignore the longer-term budgetary impacts as projects fail.

If we were to accept, on face value, the assumed strength of the global and our domestic economy, surely it would be more appropriate to have embraced the opportunity for genuine across-theboard reform to deal with structural challenges in almost every area of public policy, and to deliver earlier and sustainable budget repair.

They chose to offer limited tax “relief” rather than attempt to solve the cost-of-living problems directly. Voters will be naturally cynical.

The personal tax changes are politically motivated and structured. They push much of the final cost, along with the still promised corporate tax cuts, into the 2020s, on top of some significant spending commitments in education, health, the NDIS, defence and infrastructure. They reduce the progressivity of the system, in the context of an effectively targeted welfare system, which underpays benefits such as Newstart and the base pension.

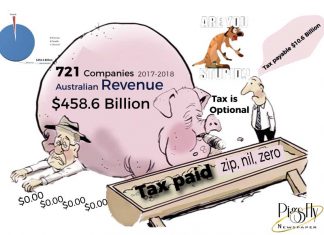

Genuine tax reform would have to address the structural weaknesses of our tax system, its inefficiency, its lack of resilience, its complexity and its inequity (including the transfer system). The need to broaden the tax base including the GST; to address the excesses and inequities of tax concessions/ expenditures; the full treatment of bracket creep; multinational tax avoidance; the proliferation of the “tax industry”; and so on.

Too many policy challenges have been kicked along for too long, while debt has been accumulated to a level where we are particularly exposed to, say, a significant increase in global interest rates, or another GFC, with virtually no policy capacity to respond.

This budget will not be remembered for its “sins of commission”, but rather its “sins of omission” – the sin of not doing what we should do, especially when we have a unique opportunity to do it.

John Hewson is a professor at the Crawford School of Public Policy, ANU, and a former Liberal opposition leader.

‘It is easy to build an attractive list, and ignore the longer-term budgetary impacts as projects fail.’

John Robert Hewson AM is a former Australian politician who served as leader of the Liberal Party from 1990 to 1994. He led the Coalition to defeat at the 1993 federal election. Hewson was born in Sydney.

Originally published in the SMH 10th May 2018

Dr John Hewson is an economic and financial expert with experience in academia, business, government, media and the financial system. He has worked as an economist for the Australian Treasury, the Reserve Bank, the International Monetary Fund and as an advisor to two successive Federal Treasurers and the Prime Minister. In February 2014, Dr Hewson joined the Australian National University as Professor and Chair of the Tax and Transfer Policy Institute.

The Australian Institute 2018 Budget Review

The table below shows how much of the tax cut each group gets after the tax cut is fully implemented in 2024.

| Low income earners | Middle income earners | High income earners | |

| Proportion of tax cut recieved |

7% | 31% | 62% |

| Approx. number of taxpayers | 3 million | 5 million | 2 million |

High income earners are by far the biggest winners from this tax cut. They get about twice the proportion of the tax cut as middle income earners, despite the fact that there are less than half as many as there are middle income earners. High income earners get over 60% of the tax cut, while middle income earners get only about 30% of the cut.

Low income earners largely miss out, getting only 7% of the value of the tax cut. This means high income earners get about 9 times more in tax cuts than those at the bottom.

If we look even more closely, we see that the further up the income scale you go, the bigger the benefit. While the top 20% (high income earners) get 62%, the top 10% (very high income earners) get about 40% of the tax cut.

If we look more closely at low income earners we see that while the bottom 30% (low income earners) get only 7% of the cut, very low income earners (the bottom 10% of taxpayers) get just 1.5% of the tax cut.

The Australian Institute 2018 Budget Review