Banking encourages cheating

Any meaningful shift in the finance sector’s corporate culture will have to come from within, writes David Kinley.

Do banking and finance attract cheats or create them?

This was the question a team of behavioural economists from Switzerland set out to answer in a ground-breaking experiment in 2014.

They took 128 bankers and separated them into two groups of 64. They primed the first group with questions about their personal life (their family, hobbies, favourite foods) and primed the second group with questions about their roles and responsibilities at the bank. The researchers then asked everyone in both groups to toss a coin 10 times and record the results. But they added this important rider – you’ll get $20 for every head you record; nothing for tails. So what did they find?

Well, obviously, if there’s no cheating, you’d expect something close to equal numbers of heads and tails across both groups. And so it was for the first group of bankers: 51 per cent heads, 49per cent tails. But for the second group – bankers thinking ‘‘banking’’ thoughts – the results were different: 58.2 per cent recorded heads, including five (out of 64) who claimed all 10 tosses were heads.

The figures from the second group are statistically significant deviations from pure chance and led the team to conclude that the prevailing culture in banking “favours dishonest behaviour”.

If we didn’t suspect that was the case before, we know it now. The evisceration of the finance sector by the banking and finance royal commission has been shocking to behold and excruciating for financiers.

Last week’s damning report from APRA of “widespread complacency” throughout the management of the Commonwealth Bank and “inadequate oversight” on the part of the bank’s board, rubbed salt into the wounds.

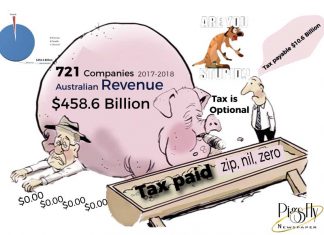

The problems throughout the sector are “systemic and unconscionable”, as former Australian Competition and Consumer Commission head Allan Fels laments. But while it is corporate culture that has brought about this pitiful state, it is also corporate culture

Top-down . . . reform is long overdue.

That can get the banks (and the rest of us) out of it. For if the Swiss experiment tells us anything, it is that all of us – not just bankers – are an impressionable lot.

Ply us with pizza and talk about the kids and we’ll act benignly. But dip us into some competitive KPIs and attach dollar signs to them, and we’ll rip off the trusting and bill the dead.

So if we can change the incentives, the reasoning goes, we can change culture; and if we can reconfigure the culture in banking and finance, we can have an all new, socially responsible and still profitable financial system.

At least, that’s the theory. Cultural change, however, is notoriously hard. In the case of finance, legal rules and regulatory authorities exist that should be enough to quell criminality and promote ethical behaviour. Together, the Corporations Act and the Criminal Code outlaw fraud, theft, misleading and deceptive conduct, bribery and corruption, and both

APRA and ASIC have power to enforce those provisions in their respective spheres.

Yet, as we have seen in the case of ASIC, its record of financial sector prosecutions, let alone convictions, is threadbare, as it prefers (and even more so the misbehaving financiers) to negotiate ‘‘enforceable undertakings’’.This is a ploy that has manifestly failed to deter offenders, as the records of recidivism within the finance sector grow ever longer.

And while we are not alone in this alternative universe of being soft on white collar crime – US banks and bankers have been avoiding convictions and jail time for years through the well-worn device of ‘‘deferred prosecution agreements’’ – it doesn’t make the situation any more palatable. All business executives are also subject to a set of directors’ duties under the Corporations Act that require all directors to act in good faith in the best interests of the company, to exercise care and diligence, and to avoid conflicts of interest. These responsibilities should form the foundations upon which corporate culture is built.

Yet, in practice, so much depends on how you define these unavoidably open-ended terms. It may be true, as many directors (and their lawyers) are wont to argue, that you cannot legislate for something as organic and intangible as promoting a ‘‘good culture’’. But, equally, recognising ‘‘bad culture’’ – like instituting incentive schemes that reward fraud and dishonesty, or lying to a regulator – and rooting it out would certainly be steps in the right direction.

The most effective and sustainable shift in the finance sector’s corporate culture will have to come from within the sector itself. Leadership – of the sincere, mould-breaking sort, rather than the wait till it blows over, Band-Aid kind – is needed.

The steady torrent of financial skulduggery we are now witnessing is a “wake-up call”, as Treasurer Scott Morrison called the APRA report on the CBA, but once awake, who in the upper echelons of finance is going to take heed and act accordingly?

Initiatives like the newly established Financial Adviser Standards and Ethics Authority, which aims to professionalise the financial advisory sector by introducing minimum educational standards, training programs and code of ethics, are a good start, if too late for many, but they are working from the ground up.

Top-down, systemic reform in the ways our financial institutions are managed and controlled is long overdue.

An established culture of careless disregard for customers, clients and corporate regulators are signs of a sector in need of rescue from itself.

Of the data collected in the Swiss experiment, the most telling of all came from its survey of which sectors in society the general public believed would be most likely to cheat in the coin-tossing exercise. Banking topped the list, ahead of even prison inmates. Not that that would surprise us anymore.

David Kinley is professor of human rights law at the University of Sydney.