MYEFO 2018

A matter of integrity commission

John Hewson asserts in The Saturday Paper

In December 2018, 34 former judges wrote a letter to the prime minister expressing their support for the...

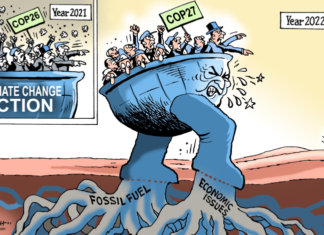

The two great stupidities behind our inflation

Alan Kohler asserts

It’s a bit like chemotherapy that kills the cancer by taking the patient to death’s door.

Here’s a wild idea for mainstream economists...

Who is responsible for online betting bombardment

South Australia's gambling tax highlights the regulatory mess of online betting

William Hill is among the online bookies to be registered in the Northern Territory,...

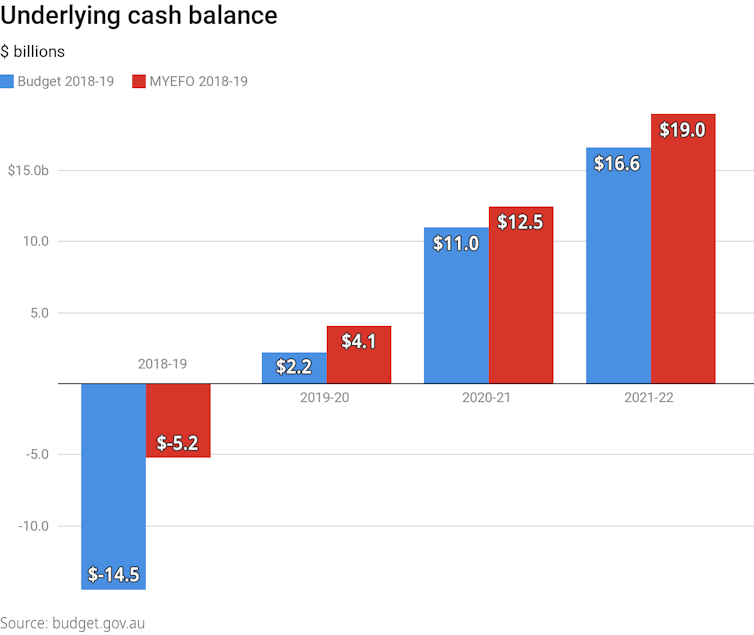

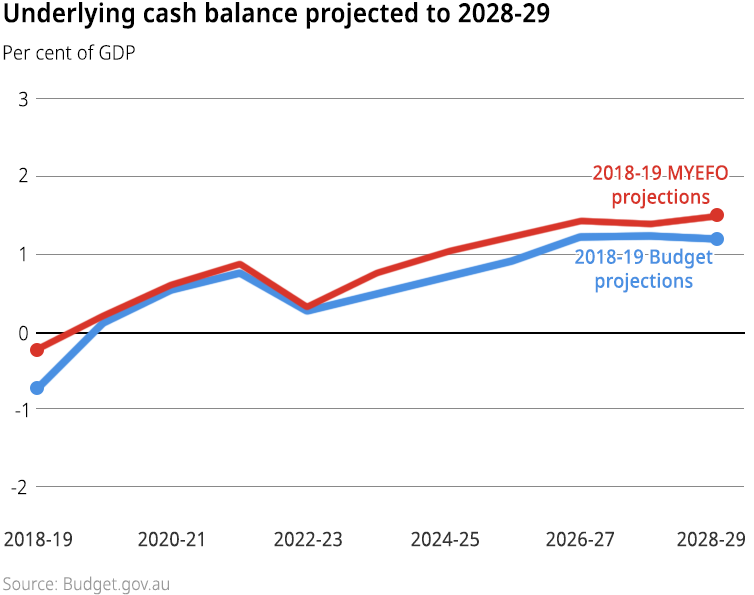

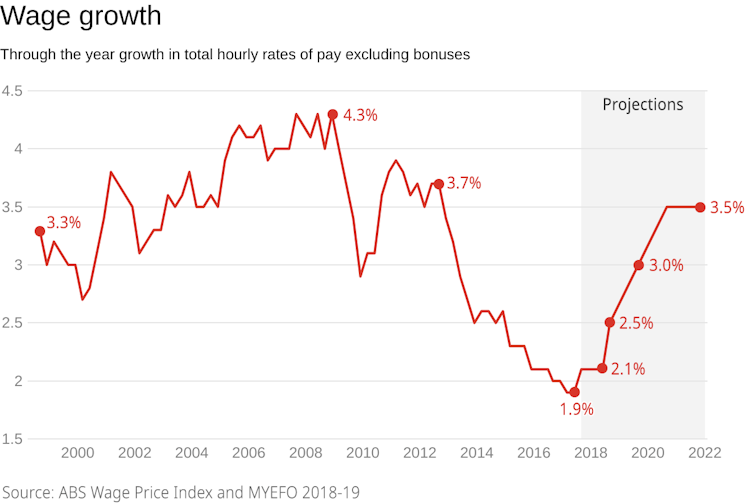

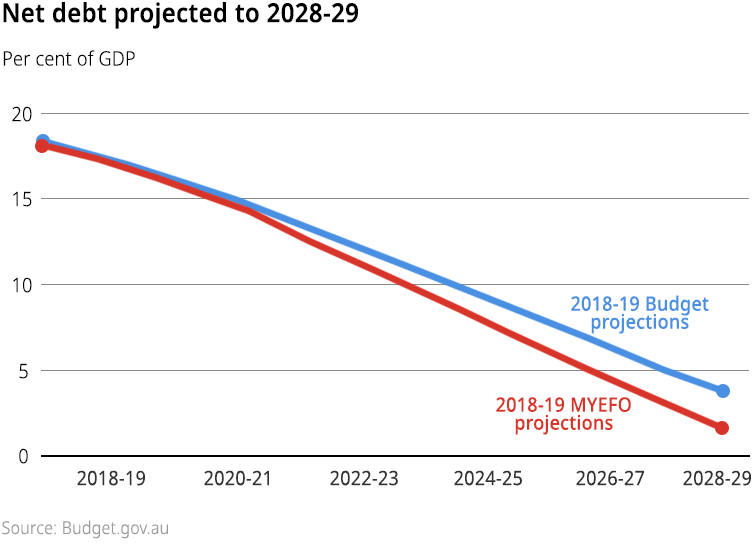

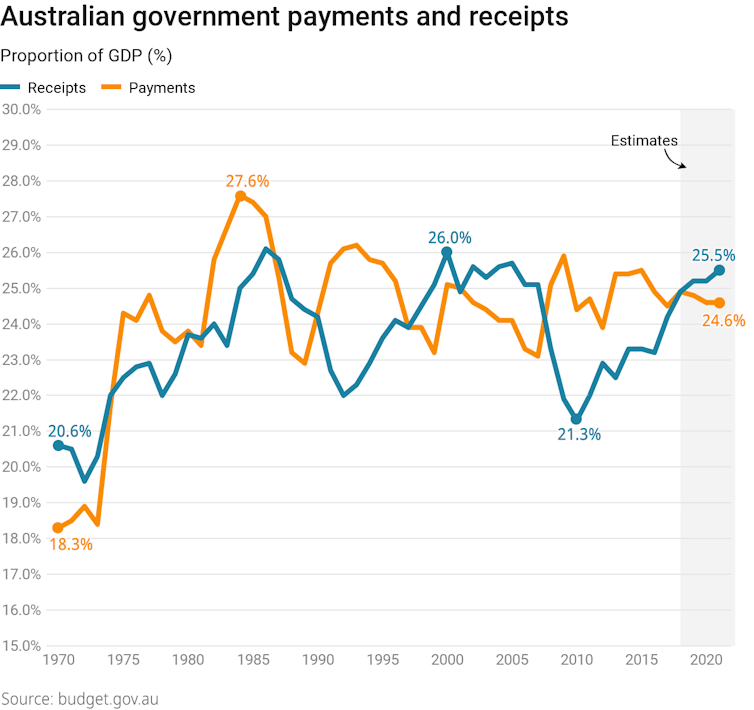

A cheat sheet for reading the federal budget

The budget papers aren’t so scary, if you know how to read them.

Lukas Coch/AAP

Phil Lewis, University of Canberra and Anne Garnett, Murdoch University

The federal...

BVD Tesla Electric Vehicles

Elon Musk once scoffed at the notion that BYD could compete with his company. Now, the automaker run by billionaire Wang Chuanfu is poised...

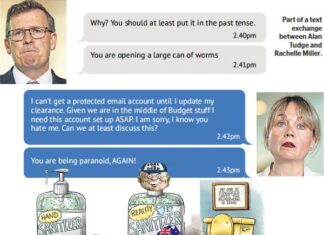

Alan Tudge, Scott Morrison and who knows what about Rachelle Miller’s...

Katharine Murphy The Guardian's Political editor writes

One of the stranger stories in this campaign has been the travails of Alan Tudge – Schrödinger’s minister...

Paying the piper and calling the tune? Following ClubsNSW’s political donations

Paying the piper and calling the tune? Following ClubsNSW's political donations

Former NSW premier Barry O'Farrell struck a deal with ClubsNSW while in opposition.

AAP/Dan Himbrechts

Charles...

Ministers’ diaries: taxpayers deserve transparency on what MPs are doing

The states that already allow their citizens to have some idea of what their highly paid ministers are doing are extending that transparency, yet...

How men without substance squander success and leave politics diminished

Bernard Keane writes in Crikey

As Boris Johnson noted, in his ungracious and reluctant resignation speech, he departed despite a large mandate. He had won...

Has the CSIRO Sold its soul

Australia’s new Labor government is committed to a transition to clean energy and a cut in emissions of 43% by 2030. But the MP...

Kamala Harris

Unmasking the Racist Dog Whistle: A Call to Arms Against the Trump-Led Republican Party

On Sunday, the New York Times revealed a chilling campaign orchestrated...

Murray-Darling Basin Royal Commission Report

South Australian report also finds negligence and unlawful actions in drawing up multibillion-dollar deal to save river system

Let's go through the responsible ministers' responses,...

Bank leadership clearout needed to clean up culture

The current executives and boards of the nation's banks are not the right people to repair the financial industry's damaged culture, says Graeme Samuel,...

Morrison’s Revelation: Australia has been living in a theocracy and we’re...

As the Liberal Party surveys the disaster of the 2022 election, it needs to read the sermon Scott Morrison delivered to Margaret Court’s church,...