Pigsfly News is creating a cut through on the Donald Trump trial saga.

We will help you understand what has been decided –

that Trump has been found guilty of financial fraud

and what is unfolding now. While part 1 is the intro it sets the stage as we unravel and simplify “The What Next?

Her father died of lung cancer in 2008 during her second year, and Ocasio-Cortez became involved in a lengthy probate battle to settle his estate.

She has said that the experience helped her learn “first-hand how attorneys appointed by the court to administer an estate can enrich themselves at the expense of the families struggling to make sense of the bureaucracy”

After college, Ocasio-Cortez moved back to the Bronx and took a job as a bartender and waitress to help her mother—a house cleaner and school bus driver—fight foreclosure of their home.

Ocasio-Cortez began her campaign in April 2017 while waiting tables and tending bar at Flats Fix, a taqueria in New York City’s Union Square.

“For 80 percent of this campaign, operated out of a paper grocery bag hidden behind that bar”.. Was fond of saying “You can’t really beat big money with more money.

You have to beat them with a totally different game.”

Pigsfly News cuts through the Donald J Trump lies. Part 1 "Found guilty but hey I always spin it my way"" Well maybe not this time!

Mostly hidden from the public consciousnesses through years of spin, obfuscation, bluster and sheer bullshit the emperor has been discovered to have no clothes.

-

Donald Trump declared to be a rapist

-

Donald Trump found to have repeatedly committed fraud

-

Donald Trump’s business licensees cancelled

Trump attends court after being found guilty of repeated financial fraud.

In a pattern familiar to most Trump belittled the Judge, singled to his rabid followers that racist bigoted antisocial beliefs, values and actions were not only acceptable but to be celebrated and acted upon

rump attends court after being found guilty of repeated financial fraud.

As much as Trump attempts to twist distort and blatantly lie. Trump has no input into the trial – as the purpose of the trial – is not to exonerate him. Trump has already been found guilty of financial fraud and this trail is to decide how much the Trump oganisation must disgorge. The trial is attempting to determine how large the refund of the ill gotten illegal gains and profits are be given to the court. T

T

Additionally all of the Trump businesses – approx 500 limited liability companies – in New York have had their licensees cancelled. Effectively Trump can not carry out any business in New York It cannot raise fiance, it cannot loan money, it cannot borrow money. All assets have been given over to a court appointed monitor – similar to a bankruptcy trustee in Australia

D.C.: Federal case on 2020 election

The details: Trump faces four federal charges for alleged efforts to overturn the results of the 2020 election.

Planned trial date: March 4

What happened: In addition to filing their motion to dismiss, Trump’s lawyers renewed their efforts to delay the trial timeline. That’s been a common theme in these cases, which Trump — the GOP presidential front-runner — would like to postpone until after the November 2024 election.

- Trump’s team said in a filing that prosecutors working for special counsel Jack Smith are not giving them enough time to write motions and prepare. His lawyers said prosecutors are pushing a fast timeline and denying Trump his “constitutional right to present a defense.”

- Ultimately, judges decide the timing of trials. Prosecutors have said that Trump’s team has ample time and accused his lawyers of deploying delaying tactics.

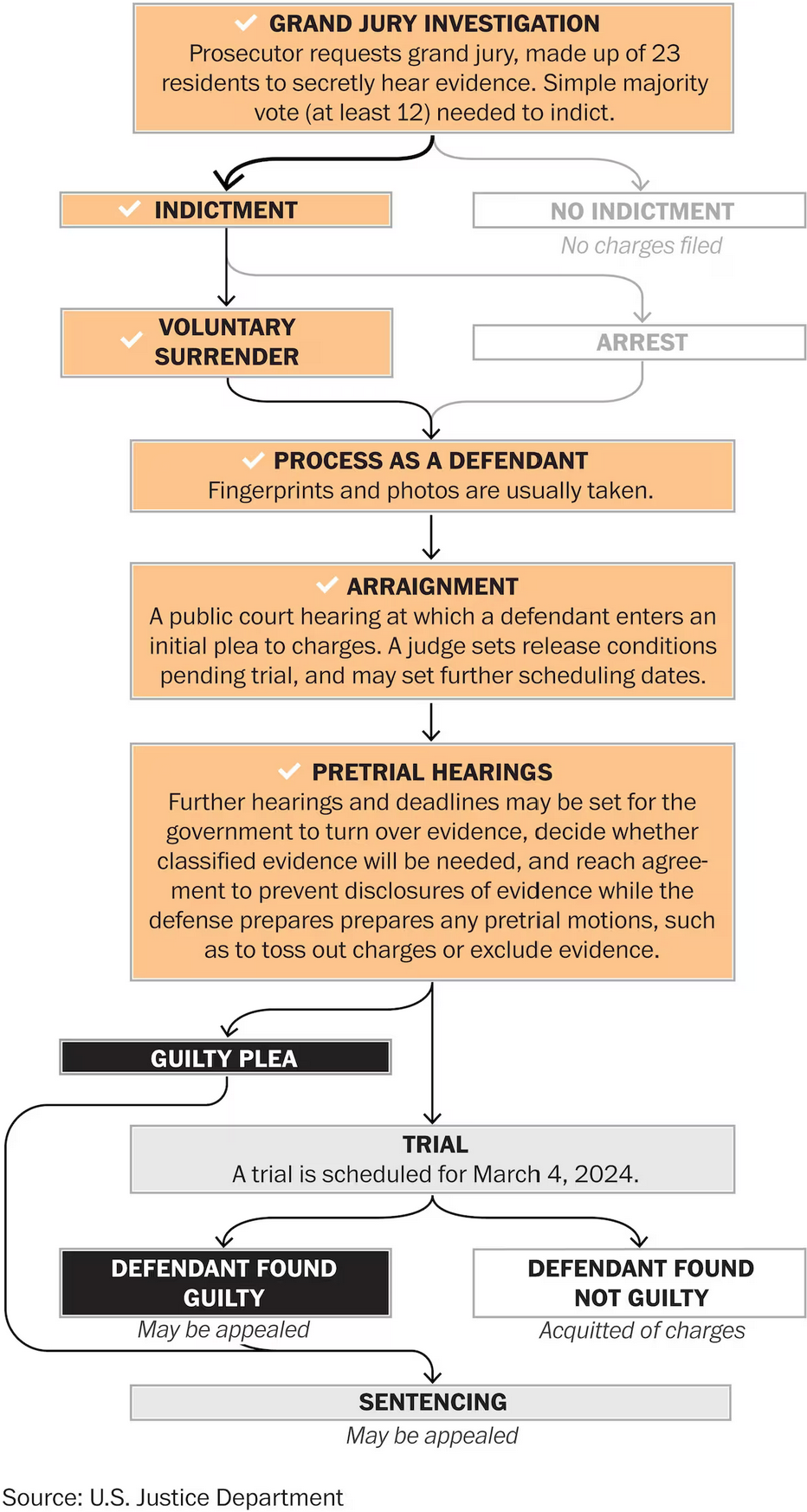

- Here is our chart showing the steps from indictment to trial and beyond:

Georgia: State case on 2020 election

The details: Trump faces 13 state counts, with prosecutors alleging that he tried to undo the election results in that state.

Planned trial date: None yet, though two of Trump’s 18 co-defendants are scheduled for trial Oct. 23.

What happened: No major developments in Trump’s case, but one of his co-defendants made news: Fulton County Superior Court Judge Scott McAfee rejected former Trump attorney Sidney Powell’s attempt to get the case against her dismissed.

- Our colleague Holly Bailey reports that Powell had claimed prosecutors withheld evidence that would have exonerated her – a claim one prosecutor called “absurd.”

- McAfee said he had no authority to dismiss charges at this stage, and a jury should decide Powell’s guilt or innocence.

For the British comedy fans, from our colleague Amy Gardner: McAfee appeared to make a Monty Python reference when he rejected co-defendant Kenneth Chesebro’s request to dismiss his indictment because one of the special prosecutors apparently did not properly document that he’d been sworn in to work on the case, as required under Georgia law.

“As if this parrot of a motion is somehow not yet dead,” McAfee wrote, alluding to the famous Monty Python dead parrot sketch.

Florida: Federal classified-documents case

The details: Trump faces 40 federal counts over accusations that he kept top-secret government documents at Mar-a-Lago — his home and private club — and then thwarted government demands that he return them.

Planned trial date: May 20

What happened: Trump’s team once again asked Judge Cannon to push the trial back until after the presidential election, citing the difficulties of accessing all of the classified evidence.

Some of the documents are considered so sensitive, the government is still searching for a safe place to store them in Florida.

In a filing, Trump’s attorneys said it was not feasible for them to meet an Oct. 10 deadline to file motions related to the classified evidence.

- They cited a number of technical reasons as to why they can’t make the deadline, including that a top Trump lawyer, Chris Kise, still does not have the necessary security clearance to review all the classified evidence. Kise also has been very busy representing Trump in a New York civil trial that began last week.

New York: State business fraud case

The details: Trump faces 34 state counts in connection with hush money paid to adult-film actress Stormy Daniels during the 2016 campaign.

Planned trial date: March 25

What happened: Trump’s team asked New York Supreme Court Justice Juan Merchan to dismiss the case, arguing in a filing that the prosecution reflects an unjust effort that relies on novel legal theories and a problematic witness — Trump’s former lawyer Michael Cohen.

New York fraud case: Separately, the civil trial to determine whether Trump and his company misrepresented business deals by drastically inflating the value of his real estate properties began last week. Our colleagues Shayna Jacobs, Jonathan O’Connell and Mark Berman have been reporting on the lawsuit.

- Trump was not required to attend, but he showed up on several days, denouncing the process as unfair in speeches outside the courtroom.

- Judge Arthur Engoron, who is overseeing the trial, issued a gag order against Trump after Trump posted a photo of a member of the court staff on social media, along with a disparaging message. The gag order prohibits Trump and other parties in the case from making public comments about court staff. The photo of the employee appears to have been deleted, on Engoron’s orders.

Nerd word of the week

Your nerd word of the week is … Discovery.

In every trial, prosecutors must give defense attorneys the evidence they have collected so they can build a defense for their clients. This is known as the discovery process. It can consist of millions of pages and, in Trump’s document case, the equivalent of years of security footage.

All four of Trump’s criminal trials are in the discovery phase — a process that plays out behind closed doors.

Question time

Why does the Trump defense team need to review the classified documents at all? Isn’t it enough just to say they were clearly marked classified?

Two reasons.

First, to win a conviction, prosecutors must show that the documents contain information “relating to the national defense,” meaning the information is closely held by a relatively small number of people in government and not available to the general public. The defense may try to argue that the information is not particularly sensitive; to mount such a defense, it needs access to the documents.

Second, prosecutors must prove the defendant acted willfully, meaning with the specific intent to do something illegal. The type of information in the documents is relevant to deciding willfulness. Prosecutors may claim the documents were so sensitive, the defendant had to know he was acting unlawfully. And defense lawyers may try to convince the jury the information was so harmless it shows there was no willful lawbreaking.

A few years later, expert appraisers told Trump his 70-story office building at 40 Wall Street in Manhattan, steps from the New York Stock Exchange, was worth $260 million. But Trump soon claimed in financial documents that it was worth nearly $530 million, more than doubling its value.

In 2018, while he was president, Trump’s company cited a seasoned New York valuation expert to claim in its financial statements that Niketown, a luxury retail store adjoining Manhattan’s Trump Tower that has since closed, was worth $445 million. The expert later told investigators he’d provided no such input and Trump’s process to arrive at the figure didn’t “make any sense.”

Those details are drawn from thousands of pages of court documents prepared by New York Attorney General Letitia James as evidence in the fraud case she has filed against Trump. The documents show how accounting, banking and real estate experts repeatedly informed Trump how much his properties and businesses were really worth. But over and over again, the documents reveal that Trump, his adult sons and top executives allegedly ignored or sidelined those experts, exchanging their figures for numbers from another source: Trump’s own intuition.

Over more than four decades as a developer, Trump — now the leading candidate for the 2024 Republican presidential nomination — has routinely exaggerated how much he and his assets are worth, while minimizing or omitting liabilities and debts. These self-aggrandizing boasts were central to the reputation he cultivated as a real estate mogul.

The civil trial against Trump’s business that on Tuesday entered its second week threatens to reveal the internal workings of Trump’s business in never-before-revealed detail. James, an elected Democrat, and her team arrived at trial armed after having reviewed millions of pages of documents about him and his company, a trove of legal ammunition that will be detailed in court in coming weeks.

James’s office has been investigating Trump’s business for more than four-and-a-half years, using a team of lawyers and forensic accountants to acquire documents through subpoenas to his company, banks, insurers and business partners, many of which would otherwise have remained confidential.

The attorney general’s team by the time the lawsuit was filed interviewed 65 witnesses, including his adult children and nearly all of his closest business confidants.

That includes individuals with knowledge of intimate details of his business who managed to remain out of the limelight during Trump’s presidency, but who were compelled to provide lengthy depositions for the first time in the case and are now prepared to testify against him and his company during the coming weeks and months.

The case is expected to feature Trump’s own testimony. Attorneys on the case will also point to a deposition Trump sat for after initially avoiding questions by invoking his Fifth Amendment right not to answer questions for fear of self incrimination more than 400 times, using it for every question.

“Appraisers are right and wrong. Everybody knows that,” he said during an April session with James’s office, according to a transcript of the deposition filed with the court. He then defended making estimates based on gut instincts.

“You use common sense. You use some other things. You know, people come up with numbers. Sometimes they’re right. Sometimes they’re wrong,” he said.

At issue in the trial that opened last week in New York Supreme Court in Manhattan are allegations that the Trump Organization and some of its executives allegedly issued fraudulent annual statements for a decade beginning in 2011, including sharply different real estate values than what Trump actually owned.

“The defendants knew that the statements were false,” Kevin Wallace, a lawyer in the New York state attorney general’s office, argued in his opening statement on Oct. 2. “They then used them to obtain and maintain benefits they were not entitled to.”

Timothy O’Brien, a journalist who has chronicled Trump and his career for decades, said the attorney general’s case touches on what may be the former president’s biggest insecurity and it appears to be the first time his practices for valuing his business have been examined in a courtroom.

“His self-worth is completely tied up in money and a pecking order that he associates with wealth,” O’Brien said. “He spent the better part of his 77 years lobbying the media and banks — and anyone else who wanted to listen — to consider him far, far wealthier than he is because that’s what he associates with success.”

Justice Arthur Engoron has already found the company broadly committed fraud, ordering the cancellation of Trump business certificates as punishment. An appellate court has temporarily blocked the order from taking effect.

Engoron will determine at the end of a trial that could last nearly three months if specific illegal acts were employed to advance the fraud. If he finds in James’s favor, he could order the repayment of $250 million in allegedly ill-gotten gains and could make it nearly impossible for Trump to do business in the state.

The vivid courtroom display threatens to undermine the persona that Trump aggressively crafted throughout his career — one that carried him to stardom on “The Apprentice” and to the White House in 2016 — and may help explain why the case has appeared to particularly enrage the former president.

Trump personally attended the first several days of the trial, turning what is otherwise an orderly process into a spectacle by offering tirades to the media each time he stepped in and out of a private room in the courthouse where he and his team were assigned to wait between courtroom sessions. He repeatedly blasted the proceedings on social media.

The defense has said Trump’s valuations were the result of his keen sense for development potential and the value of his own brand, a similar argument he has made for decades when challenged about the size of his business.

When Trump was first required to file a government disclosure form during his 2015 campaign, he issued a statement saying his net worth was now “in excess of TEN BILLION DOLLARS.” His own 2015 financial statement, relying on several disproven figures, showed a net worth of $4 billion less.

A Forbes journalist asked him that year why he cared so much — why had he gone to such great lengths to inflate his wealth? “It was good for financing,” Trump said.

Therein lies the crux of James’s case: that Trump used his inflated financial statements to obtain preferential treatment from banks and insurers, conduct that she argues violates state law due to its “capacity or tendency to deceive, or creates an atmosphere conductive to fraud.”

Trump and his attorneys counter that no lender lost money because of the figures Trump included on his financial statements. In depositions, Deutsche Bank employees testified that the bank recorded millions of dollars in profits as a result of loans to the Trump Organization.

The parade of witnesses that will reveal new details about how Trump’s company operates began as the trial opened last week.

Former Trump Organization controller Jeffrey McConney testified that he and longtime Trump Organization finance executive Allen Weisselberg repeatedly reached steeply inflated values for company assets using illusory methods.

For instance, McConney testified Friday about the valuations of a dozen Trump Park Avenue condominiums. The Trump Organization valued the condos at $50 million in 2011 and 2012 and nearly $136 million in 2020, even though company executives knew they were rent stabilized, meaning they could not be sold as regular condos, according to trial evidence. During the depths of the country’s financial crisis in 2010, they had even been appraised for as low as $750,000 in total, and in an appraisal a decade later, for $84.5 million— still far below what the Trump Organization claimed properties were worth, documents show.

Asked on the stand if he and Weisselberg discussed misrepresenting the value of the rent-regulated New York apartments, McConney responded: “I believe so, yes.”

McConney played a central role in gathering information about the company’s assets and compiling them in spreadsheets named “Jeff’s supporting data,” according to a deposition McConney gave to James’s team in early 2020. McConney and Weisselberg, his then-boss, are defendants in the case. Both no longer work at the company.

Longtime Trump accountant Donald Bender testified that he compiled Trump’s annual statements of net worth without verifying the figures. Bender worked for Mazars USA, the accounting firm that handled Trump’s business and personal tax returns until 2022, when the firm announced that it could no longer stand behind the statements and cut ties with Trump.

Bender testified that he received the numbers from McConney and Weisselberg, who took the witness stand on Tuesday. Bender testified he did not violate generally accepted accounting practices, but often did not ask for appraisal information from the company to back up their figures.

The financial statements compiled by Bender all came with a cover letter warning that the values contained in the report were not verified. The defense has pointed to that warning as proof that banks and insurance firms didn’t rely on the figures.

In his deposition, Trump said the letter included a “worthless clause” — a line that he said was intended to notify recipients that they needed to do their own analysis.

“I have a clause in there that says, don’t believe the statement, go out and do your own work,” he said.

Other insider details about the company are likely to emerge in coming weeks, including new information about how Trump misdescribed his own famed Trump Tower apartment.

When the Chubb insurance agency sent an appraiser to determine the value of Trump’s triplex apartment in 2010, he was not allowed to see the primary bedroom because he was told “Mrs. Trump was sleeping,” according to James’s complaint.

Seven years later, Forbes — citing real estate records — published a story titled “Donald Trump Has Been Lying About the Size of His Penthouse.” Trump subsequently dropped the value of the unit from $327 million in 2016 to $116.8 million in 2017.

In his April deposition, an attorney for James asked Trump directly how big his apartment was. “I don’t know … I would think it would be 12 or 13,000-square-feet,” Trump said. He said he agreed with the 2017 reduction in value, but ducked questions about why the unit was misvalued in the first place and how the reevaluation came about, details that could come out at trial.

Information about how Trump valued other key properties in his real estate empire — his 40 Wall Street office building, his Park Avenue condos and a minority stake he owns in another office tower — are likely to be revealed as well.

A transcript of Trump’s April deposition shows that he said he valued 40 Wall Street at more than double a bank-commissioned estimate, which James’s team found in the company’s files, because “bank appraisals are always low.”

He also said he boosted the value because he was considering replacing the offices with a more valuable luxury condominium tower. But he did not deduct the costs that would be involved in that kind of transition, like getting zoning approvals or erecting a colossal residential project.

James’s court filings showed the company often provided business partners with only hard copies of Trump’s financial statements instead of electronic versions. Some insurers weren’t given copies of his statements at all and instead were asked to sit in a room and read Trump’s copies. The practices, she argued, were intended to make it harder for other companies to question the Trump Organization’s figures.

When asked about who prepared his financial statements, Trump said in his deposition: “For the most part my people did this. They would give me a statement. I would certainly look at it. But I had not a lot to do with it.”

But in court filings, James has revealed who her investigators believe has been in charge of preparing the documents since Trump became president: A “junior employee, only a few years out of college and with no professional accounting training.”