Energy crisis: The truth behind the price surge

The near collapse of the east coast energy market has its roots in decades of political appeasement directed at fossil fuel interests.

As Australia grapples with the near collapse of its east coast energy market, there are a few names worth remembering.

As Australia grapples with the near collapse of its east coast energy market, there are a few names worth remembering.

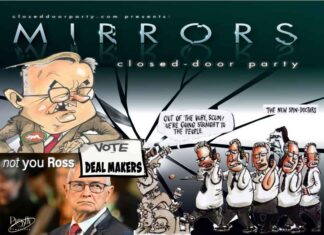

These are markers of an unhealthy symbiosis that has been little mentioned among the contributing factors to the crisis, although they are at the heart of most of what has gone wrong.

Take Brendan Pearson. He was chief executive of the Minerals Council of Australia when the body gave Scott Morrison the lump of coal he carried into parliament. Subsequently, he was hired as a senior adviser in the Prime Minister’s Office. Already in the office was a former deputy chief executive of the Minerals Council, John Kunkel, who was working as Morrison’s chief of staff.

Or take Ian Macfarlane, who was appointed chief executive of the Queensland Resources Council within a few months of leaving federal politics. Macfarlane had been Resources minister in the Howard government from 2001 to 2007.

His Labor successor, Martin Ferguson, retired ahead of the 2013 federal election and promptly became a board member with a gas company. Later, he became chairman of the advisory board for the Australian Petroleum Production and Exploration Association, which calls itself “the voice of oil and gas” in Australia.

Or take Alexander Downer and Ashton Calvert, who were respectively minister and secretary of the Department of Foreign Affairs and Trade when Australia clandestinely installed listening devices inside Timor-Leste’s cabinet offices to gain advantage in negotiations over oil and gas reserves. Both men subsequently took lucrative employment with a corporate beneficiary of those negotiations, Woodside Petroleum (now Woodside Energy).

“I think it’s quite possible there’ll be a few tough, tough years. I think it actually reflects deeply problematic underlying issues, which I think are the consequence of neglect at a federal level.”

There are innumerable other examples of people coming out of the fossil fuel industry and into roles advising government, serving on regulatory agencies, even sitting in parliament, and of former politicians, staffers and bureaucrats moving onto boards or executive jobs or as lobbyists for fossil fuel companies. All have had a role to play in the energy crisis.

The fossil fuel industry owes its power not only to these carefully cultivated links but also to its generous financial support of the major political parties.

In 2020 alone, according to analysis of electoral commission returns by the progressive think tank Market Forces, fossil fuel miners donated at least $1,353,202 to Labor, the Liberals and the Nationals – and likely more, given the inadequacy of Australia’s donations laws.

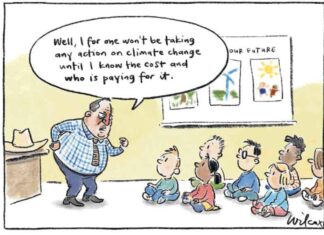

Although a number of factors contributed to the current crisis – the war in Ukraine; record heat in India; La Niña rains in Australia and Indonesia that reduced coal supply; scheduled maintenance and breakdowns at coal-fired power stations; unusually cold weather; and reduced generation from wind and solar – at the bottom of it was the politics of appeasement. For decades, fossil fuel companies were more or less allowed to do whatever they wanted, with no policy drafted to maintain the integrity of domestic energy supply.

Rod Sims, the former head of the Australian Competition and Consumer Commission (ACCC), underlined the point this week, writing a comment piece in which he blamed two things above all for the east coast energy crisis: the lack of a price on carbon and the construction of three liquefied natural gas (LNG) projects in Queensland about 10 years ago.

There are innumerable other examples of people coming out of the fossil fuel industry and into roles advising government, serving on regulatory agencies, even sitting in parliament, and of former politicians, staffers and bureaucrats moving onto boards or executive jobs or as lobbyists for fossil fuel companies. All have had a role to play in the energy crisis.

The fossil fuel industry owes its power not only to these carefully cultivated links but also to its generous financial support of the major political parties.

In 2020 alone, according to analysis of electoral commission returns by the progressive think tank Market Forces, fossil fuel miners donated at least $1,353,202 to Labor, the Liberals and the Nationals – and likely more, given the inadequacy of Australia’s donations laws.

Although a number of factors contributed to the current crisis – the war in Ukraine; record heat in India; La Niña rains in Australia and Indonesia that reduced coal supply; scheduled maintenance and breakdowns at coal-fired power stations; unusually cold weather; and reduced generation from wind and solar – at the bottom of it was the politics of appeasement. For decades, fossil fuel companies were more or less allowed to do whatever they wanted, with no policy drafted to maintain the integrity of domestic energy supply.

Rod Sims, the former head of the Australian Competition and Consumer Commission (ACCC), underlined the point this week, writing a comment piece in which he blamed two things above all for the east coast energy crisis: the lack of a price on carbon and the construction of three liquefied natural gas (LNG) projects in Queensland about 10 years ago.

That sounds like a story from last week but it was published almost five years ago. The same structural issues that were a factor then were part of the reason power prices went through the roof in recent weeks.

Those issues have been the subject of seven critical reports by the ACCC since 2018. The one this week, however, was utterly damning.

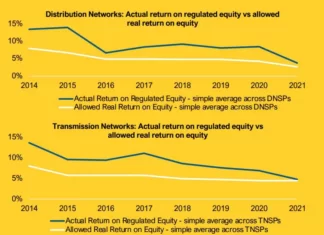

“During the first two weeks of June, wholesale electricity spot prices rose significantly,” the ACCC said. “Volume weighted average spot prices ranged from $341/MWh to $590/MWh depending on region, roughly 5 times higher than in quarter 1 2022. Base futures contracts also became significantly more expensive, reflecting market expectations of a sustained period of high wholesale prices.”

In fact, wholesale prices were very high even before that. In late April, a couple of weeks after Morrison called the election, the Australian Energy Market Operator (AEMO) reported that wholesale electricity prices were 141 per cent higher for the March quarter than for the same period a year earlier. Strangely, this did not get much attention during the campaign. The then government continued to claim it had lowered power prices.

As political luck would have it, it was only after Labor won that things went seriously pear-shaped. With prices going through the roof, the regulators intervened, imposing a $300/MWh cap, first in Queensland, then also in New South Wales, Victoria and South Australia. But this brought more problems, as AEMO noted on June 14: “As a consequence, some generators revised their market availability in New South Wales and Queensland for today. This has contributed to forecast supply shortfalls …”

That is, some generators were sitting on the sidelines, even as there was the prospect of blackouts. This brought accusations that companies were gaming the market, holding back on supply until they were directed to provide it, at which point they would receive more generous compensation.

Sarah McNamara, chief executive of the Australian Energy Council, denies her members were holding the east coast to ransom. She said generating businesses were “legitimately trying to find ways to recover their costs”, making “rational commercial decisions”.

There were also complaints that some companies were price gouging, trying to lock buyers in to contracts at excessively high prices. The ACCC is investigating.

On Wednesday June 15, for the first time in the 24-year history of the National Electricity Market, AEMO announced it had suspended the spot market “in all regions”.

“AEMO has taken this step because it has become impossible to continue operating the spot market while ensuring a secure and reliable supply of electricity for consumers,” its statement said.

“In making the announcement AEMO CEO, Daniel Westerman, said the market operator was forced to direct five gigawatts [5000 megawatts] of generation through direct interventions yesterday, and it was no longer possible to reliably operate the spot market or the power system this way.”

A week later, on Wednesday June 22, AEMO declared the worst of the crisis had passed, announcing “the activation of a staged approach to lift the suspension” following a “clear improvement in market conditions”.

The situation had gone from being potentially catastrophic to merely dire.

Much damage was done during the crisis. Heavy industries that require a lot of power were forced to curtail operations. Over the past month several smaller retailers have failed, and industry analysts expect more to follow, thus reducing competition and bolstering big operators that are both generators and retailers.

And while wholesale prices have come down from their stratospheric levels, we will see default retail electricity prices rise by up to 20 per cent in some states from next month.

Meanwhile, the companies at the top of the energy chain that dig up and sell the coal and gas are enjoying huge windfall profits.

“It’s bizarre, isn’t it?” former Treasury secretary Ken Henry said this week. “We’ve got a global energy price shock, energy prices around the world are going through the roof. Australia is an energy superpower. We have an abundance of just about every source of energy imaginable. And yet we’ve got multinational companies making extraordinary windfall profits while Australian households and Australian manufacturers reliant upon energy are getting it in the neck.”

According to a recent analysis by The Australia Institute, those companies are 95.7 per cent foreign owned. They pay little or no tax and not much, relative to other countries, in royalties. For example, Qatar, which vies with Australia as the biggest exporter of LNG, receives revenue of about 10 to 30 times as much from its exports, according to various estimates.

Everywhere except Western Australia, which has a gas reservation scheme that ensures domestic supply at prices about one-sixth of those in the east coast market, buyers are paying global prices.

Many people have suggested a resource rent tax be applied, but there are difficult issues in applying it retrospectively.

Speaking on the ABC, Henry suggested an alternative: a gas export windfall tax. He said he could see “no economic case” why that tax could not be set at 100 per cent – although there is no reason to believe this will happen and there seems to be no political appetite for it.

Professor Bruce Mountain, director of the Victoria Energy Policy Centre, expects there is worse to come for the energy market.

“I think it’s quite possible there’ll be a few tough, tough years,” he says. “I think it actually reflects deeply problematic underlying issues, which I think are the consequence of neglect at a federal level.

“Essentially, coal’s on its way out. The owners realise that and they’re not keen to maintain the plant, to spend money to keep them going. But government has not brought on the alternative quickly enough.

“And so, we’re reaching the point increasingly in the power market where we see these supply crises.”

The fossil fuel industry and some in government prescribe more gas, but that way leads to climate disaster.

The current federal government and its Energy Security Board favour a new “capacity mechanism” that would see energy companies – including coal and gas generators – paid to maintain reserve energy.

Mountain dismisses this as “a reheated wheeze” advocated by former Energy minister Angus Taylor and widely derided as the “CoalKeeper policy”.

It is unlikely the new mechanism would be in operation for several years, and already there are cracks appearing between the various component jurisdictions of the National Electricity Market, with some, such as Victoria and the ACT, insistent fossil fuels should be excluded.

Mountain proposes something else, a “renewable energy storage target” that would underwrite renewable storage, similar to the way the previously successful renewable energy target underwrote generation.

An early and strong supporter is the most prominent of parliament’s independents, Zali Steggall. Another of them, Zoe Daniel, wants multinational miners taxed on their super profits.

There seems to be a new political dynamic emerging with the influx of new people into the federal parliament – Greens and independents – who have no historical allegiance to the fossil fuel industry and appear to expect nothing from it.

Just maybe we’re seeing the loosening of the fossil fuel lobby’s tight hold on politics.

This article was first published in the print edition of The Saturday Paper on June 25, 2022 as “Energy crisis: The truth behind the price surge”.