You pay millions for these imbeciles to encourage conspiracy theories and...

We get so used to the bonkers shit that goes on in the Australian Senate that it starts to seem unremarkable. Frustrating, exasperating, eye-rolling,...

A troubling environment

Our environment is in deep trouble. We are all suffering as a result. Elected officials at all levels behave as if tackling the problem...

Energy prices leave few winners — while the rest of us...

Bernard Keane writes in The GuardianSeveral long-term trends are now intersecting in a way that is going to deepen economic divisions in Australia, as...

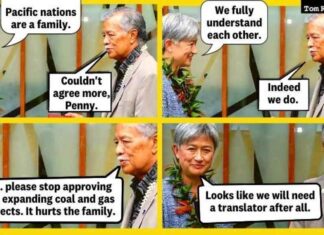

How Nationals and lobbyists play the new climate wars

By The SaturdayPaper's

Marian Wilkinson

Young and with a ready smile, James Thomson appears an unlikely foot soldier in the new climate wars. But the Maitland...

Annabell Crab mussings

Western democracy was so much easier 300 years ago, when it was illegal for journalists to report the goings-on in Parliament.

In those days, politicians...

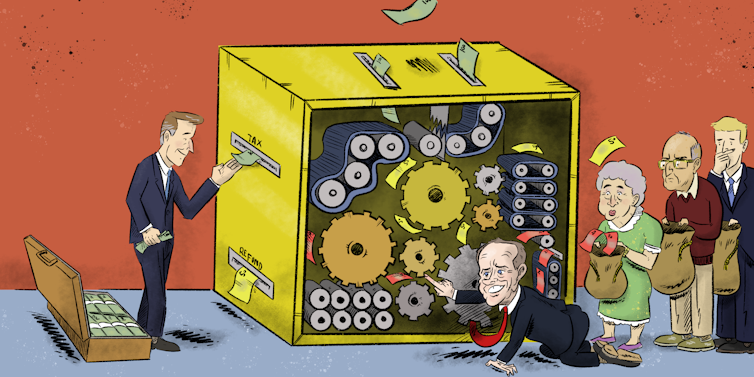

Negative gearing changes will affect us all, mostly for the better

Negative gearing changes will affect us all, mostly for the better

Don’t have a negatively geared investment property? You’re in good company.

Despite all the talk...

Politicians in 2014 held $300m in property, so how should they...

Canberra’s 226 MPs and senators own 524 properties between them – an average of 2.4 each – analysis by the ABC has found.

Only 10...

Franking credits: everything you need to know

What are franking credits, how do they work and who is entitled to them?

What is a franking credit?

Franking credits are only available to...

Taxpayers should not be subsidising lifestyle of wealthy retirees

A reverse death tax that helps the rich

The dividend imputation system is a rort Australia can’t afford, write Emma Dawson and Tim Lyons.

Australia’s dividend...

Political donations 2017-18: search all the declarations by Australian parties

Today Australian voters have discovered who was bankrolling the nation’s political parties more than 18 months ago.

Gambling lobby gave $500,000 to Liberals ahead of...

The truth about political donations: there is so much we don’t...

Approximately $15 million in donations was disclosed by donors, a small proportion of parties' total funding.

The Liberal Party received $95 million in funding across...

Coalition’s changes to finance laws could be a ‘dreadful step backwards’

“What is actually the point of undoing it? One actually asks, why do you want to do this?” he said.

“Why is it in the...

The minister the money and the mine. How a rotten deal...

As waiters took orders for toasties and coffee at the Little Teapot Café in the sleepy coastal hamlet of Davistown, NSW, four men were...

Australia’s biggest gambling operators be warned – media pack is baying...

Often enough, a single news organisation will crack an important story or begin a worthy crusade and the rest of the media ignore it...

History repeats: how O’Farrell and Greiner fell foul of ICAC

In April 2014, the New South Wales Independent Commission into Corruption (ICAC) claimed its biggest political scalp in two decades. Liberal state premier Barry...

The uncivil Mr Jones

View from The Hill: The uncivil Mr Jones

Michelle Grattan, University of Canberra

The row over shock jock Alan Jones and what will be displayed on...

The latest casino scandal is just another sideshow

Another casino, another official investigation, more allegations of money laundering, organised crime links and fraud.

At a casino? Gee, who would have guessed?

And, again, Star...

No risk: The family who own Tasmania’s gambling industry

Every single gaming machine in the state is theirs. The Keno is theirs. They own one of the two casinos and a controlling stake...

Gambling industry finds plenty of political guns for hire to defend...

Gambling industry finds plenty of political guns for hire to defend the status quo

Stephen Conroy is to head up a new gambling industry body,...