Fake Reform: Jim Chalmers’ itsy-bitsy tax “hit” is a gift for foreign fossil fuel giants

“Chalmers slaps $2.4bn tax hit on oil and gas,” cried Murdoch’s The Australian. “$2.4bn gas tax hit on energy giants,” declared the AFR. Santos chief Kevin Gallagher was nowhere to be heard with his “Soviet-style” scaremongering. Is Australia still going the way of Venezuela and Nigeria, Kevin?

Not on your Nelly. The foreign gas giants are profiteering from Australia’s resources like there is no tomorrow, and paying pocket fluff in tax to boot. Treasurer Jim Chalmers’ long-awaited tweaks to the PRRT are itsy-bitsy, the equivalent of recycling old Christmas presents with a bright new bow, really just “up-fronting” a piddling amount of gas revenue for the next few years, a clawing back of subsidies for a while.

You know it’s a fake “hit” when the fossil media talks it up as a “hit” but the gas lobbyists from APPEA say it gets “the balance right”. Reality is there is no balance, just ongoing pillage.

That’s not a tax … this is a tax

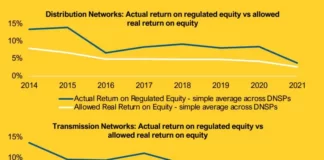

Check this chart by Daniel Bleakley comparing Norway to Australia and including the latest impact of the PRRT fiddling. To paraphrase Crocodile Dundee: “That’s not a tax … *this* is a tax.

This from CICTAR analyst, formerly with the Tax Justice Network:

“I was hoping that the government would make positive changes to the PRRT, in particular the gas transfer pricing mechanism. I had prepared a statement to celebrate changes to be announced in the budget, but these changes appear to be total BS! I have trashed my prepared statement.

“APPEA is celebrating the changes, which tells you everything. After Treasury started the consultation on the gas transfer pricing mechanism in 2019, it issued its final report yesterday (Saturday).

“It appears that it will not increase revenue raised over the life of projects, but bring forward some revenues by capping the use of deductions each year. It looks like it will raise about $2bn in the forward estimates (4 years).

This quote from the Treasury report sums it up pretty well.

“Indeed, some projects may not be sufficiently profitable to pay any PRRT over their project lives in the event of sustained lower LNG prices, regardless of the recommended change. In such circumstances, Australians will continue to forgo any return attributable to their ownership of the recovered gas.”

“So put differently,” says Ward, “The Australian government is willing to keep giving away our gas to the world’s largest multinationals in the hope that someday Chevron, Exxon and others might pay some corporate tax on the $93bn in annual LNG exports and maybe create a few jobs and sell us back some of our gas … Pretty disgraceful and very disappointing, but I guess I should not be surprised.”

As @FetchStep described it on Twitter: “Jim Chalmers, Federal Labor Treasurer, just gave that exact amount back to the gas industry in he past few months alone – $1.9b for Darwin Gas export hub, $78m to the NT frackers and $512m for a gas powered urea factory in WA. There is no “tax increase”.

This article was originally published by Michael West Media

The cruel and unfair stage three tax cuts will only worsen inequality

The tax cuts will reduce government revenue by about $184 billion in the first eight years — that means less money to spend on alleviating poverty.

Australia is one of the world’s richest countries, but our government taxes and spends far less than most other OECD members.

For decades, the richest 10% of Australians have been capturing a growing share of income, while the poorest 10% remain trapped in poverty. The stage three tax cuts will widen this divide and entrench the structural budget deficit. This is bad policy that runs counter to Australia as the land of the fair go.

What are the stage three tax cuts?

In the 20th century, Australia was one of a select group of rich nations to develop a progressive income tax system. In 1950 we had 28 tax brackets, with a top marginal rate of 75 cents in the dollar. That kicked in when annual income ticked over £10,000, which was about 33 times the average wage of a male factory worker.

Today there are five brackets with a top rate of 47% (including the Medicare levy) for incomes above $180,000 (roughly double the full-time earnings of an average male).

The stage three tax cuts will further flatten and compress the progressive rate structure by increasing the threshold for the top rate from $180,000 to $200,000. It will completely remove the 37% tax bracket and lower the next tax rate from 32.5% to 30%. This will then be the rate that applies to all income between $45,000 and $200,000.

Distributional effects v adjusting for inflation

These tax cuts significantly reduce revenue and shift the burden of taxation away from top-income earners and towards low- and middle-income taxpayers. They overcompensate high-income earners for bracket creep (the rise in the share of income paid in taxes due to inflation) while doing little or nothing to address the issue for Australians on lower incomes, who will pay more tax after the removal of the low- and middle-income tax offset from July 1 this year.

Less revenue means less spending on poverty-alleviation

The tax cuts will reduce government revenue by about $184 billion in the first eight years — that means less money to spend on alleviating poverty to improve fairness and social and economic outcomes overall.

For example, the estimated $54.1 billion in revenue foregone over the forward estimates from 2024-2027 could more than fund the combined cost of the $34 billion needed to increase JobSeeker and rent assistance to a liveable rate over the same period, the $10 billion Housing Australia Future Fund, and the $1.1 billion needed to restore the single-parent payment to continue until the age of 16 for the youngest child over the same period.

A progressive income tax is achieved not just by the rate structure but also by the base –— that is by what income we choose to tax.

When Australia’s income tax was enacted more than a century ago, we taxed income from capital at a higher rate than income from work. That differential was removed, but in the 1980s Australia introduced a capital gains tax and other reforms to significantly broaden the income tax base.

Since then, tax concessions have crept back into the law in favour of capital income. These include the overly generous capital gains discount, excessive concessions for superannuation, and negative gearing. As higher-income earners can save much more than low-income earners, this narrowing of the tax base reduces revenue and makes the tax system less fair.

As the commitment to a progressive income tax rate and broad base has declined, inequality has risen, pushing the tax burden onto the middle and benefiting the rich. Top-income earners pay a large share of tax in our system because they have more capacity to pay, but the many avenues available to well-heeled taxpayers to shelter wealth and income mean it is unlikely they pay anything close to the statutory tax rates on their actual income.

It is often argued that tax rate cuts and concessions foster economic growth. But today’s economic research suggests that taxing capital adequately is both equitable and efficient and highlights the economic damage done by growing inequality and poverty. This argument also ignores the growth and social benefits delivered to Australians by increased spending on public goods such as health, housing and education.

How to fix it?

The stage three tax cuts should not go ahead as currently designed. The government should at least return the 37% tax rate at a suitable threshold, which the Grattan Institute estimates would save $8 billion a year.

Australia needs a broader discussion about restoring the progressive rate structure and base of the income tax to capture more tax from capital and wealth. This would ensure people pay a fair amount of tax based on their ability to pay while raising the revenue the government needs to provide the services and infrastructure Australians expect and need.

Written with Professor Roger Wilkins, Professor Guyonne Kalb (Melbourne Institute of Applied Economic and Social Research) and Mr Peter Mares (Centre for Policy Development)

Should the government scrap the stage three tax cuts? Let us know your thoughts by writing to letters@crikey.com.au. Please include your full name to be considered for publication. We reserve the right to edit for length and clarity