Robodebt and the transmission of shame

Kathryn Campbell stifled a laugh when, in September 2018, she recalled the rollout of the robodebt program during her time as head of the Department of Human Services. “What happened was a number of the letters went out and people didn’t either receive the letters or respond to the letters. And the first they heard about it was when the debt collector rocked up to ask them to repay the debt,” she told an audience at the Institute of Public Administration Australia ACT chapter during a keynote address.

“So this happened in early January of 2017. That’s another lesson: try not to roll things out in January, because there is not much other media going on and you find … that’s the only headline in town.

“I kept thinking, Where are those cricketers when you need them doing something naughty? But they were well behaved that year.”

“Something naughty”. It’s a statement that reveals much about the transmission of shame. In Marlon James’s A Brief History of Seven Killings he writes of a fictional Jamaican ghetto where among seven people, all living in one room, some are fucking anyway: “people so poor that they couldn’t even afford shame”.

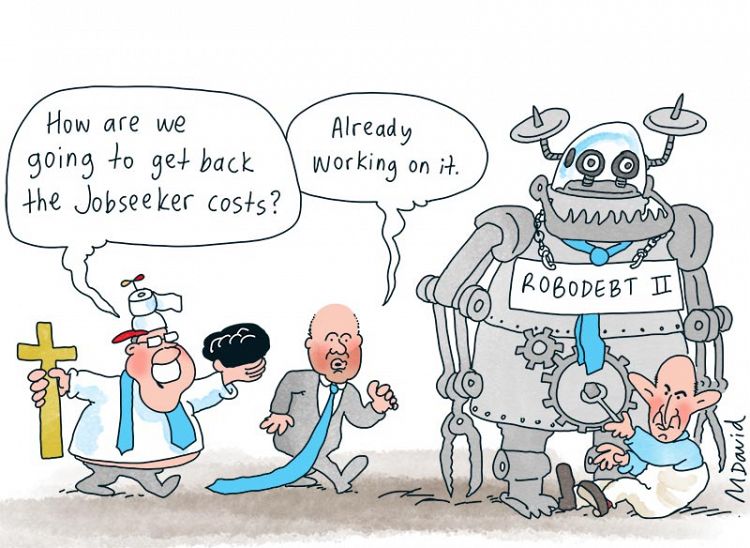

It’s the same ignominy that Campbell was looking for in the cricketers to draw attention away from an inconvenient blip in the rollout of a predatory government scheme. Cheating scandals, too much booze, sledging: failures of manners, basically. Indelicate, perhaps, but then again the Australian cricket team has never operated an illegal scam at the scale of a federal government hunting its own citizens for debts that it had knowingly made up.

Shame rarely travels the other way. It is projected down, on the poor or the moneyed bogans, the country bumpkins or public-schooled. It is difficult, for example, to get those with carriage of this scheme to admit wrongdoing. Harder still to see even a glint of remorse.

Cricketers do naughty things; government officials administer programs.

It ought to have been obvious before the start of the Royal Commission into the Robodebt Scheme, which held its first substantial hearings over two weeks in late October and early November, that this scheme was worse than “naughty”.

What the robodebt royal commission tells us about who knew what, and why it matters

The Commonwealth had settled a class action lawsuit with a total restitution of $1.8 billion. At least seven families believe the suicide of people they loved was partly or directly linked to the program. Thousands were thrust further into penury, prevented from leaving violent living situations or so mentally traumatised that their disadvantage was all but guaranteed. Even in the extremely rare cases where the government corrected its “errors”, it only began to do so – grudgingly and slowly – months after the class action case was announced in September 2019.

Campbell, of all the public servants in this diabolical episode, is the most tied to it. She was the secretary of the Department of Human Services who, on account of her minister, Marise Payne, being on leave, first briefed the new social services minister, Scott Morrison, over the Christmas–New Year break of 2014. Morrison suggested the department look at welfare compliance – again – and Campbell went away to brief her leadership team on January 5. There was already an idea bubbling away in the bowels of the enormous DHS, in its compliance risk division, where senior managers were eyeing mountains of tax office data dating back to 2010–11, like hungry cartoon characters salivating over a roast chicken. So excited about the prospect of converting that historical data, with its 867,000 “potential discrepancies”, into cash, DHS bureaucrats Scott Britton, Jason Ryman and Ben Lumley had already shared the plan with their superiors, where it was promptly referred upwards to their boss, DHS deputy secretary Malisa Golightly, who in turn floated it across town with peers at the Department of Social Services.

The fact that one hulking department in the DHS (now Services Australia) was responsible for delivering social security payments, while the other, the DSS, was allegedly in charge of policy will become important. A crucial early brick in the robodebt timeline happened when the initial concept – known as “PAYG clean-up” or “cleansing” – made it to the DSS, setting off a chain reaction of policy and legal advices requested by then deputy secretary Serena Wilson.

David Mason – then acting director of debt policy at the DSS – gave his assessment: this was a bad idea that could never be defended at a tribunal or in the court, it was unfair, and, because the DHS could only do it by shifting the obligation of providing evidence of a debt to Centrelink customers, it would fundamentally reverse the longstanding emphasis of the social security system. Finally, he added, it would likely cause serious reputational damage to both federal departments. The legal advice was only slightly less emphatic, in the way of most legal-speak, but the effect was the same: “In order to correctly determine relevant debt, it would be necessary to consider the amount of income received in each relevant fortnight in order to apply the income test in that fortnight.” Cameron Brown, then the director of payment integrity and debt management for the DSS, has since told the royal commission it was the most “black and white” legal advice you could get.

David Mason – then acting director of debt policy at the DSS – gave his assessment: this was a bad idea that could never be defended at a tribunal or in the court, it was unfair, and, because the DHS could only do it by shifting the obligation of providing evidence of a debt to Centrelink customers, it would fundamentally reverse the longstanding emphasis of the social security system. Finally, he added, it would likely cause serious reputational damage to both federal departments. The legal advice was only slightly less emphatic, in the way of most legal-speak, but the effect was the same: “In order to correctly determine relevant debt, it would be necessary to consider the amount of income received in each relevant fortnight in order to apply the income test in that fortnight.” Cameron Brown, then the director of payment integrity and debt management for the DSS, has since told the royal commission it was the most “black and white” legal advice you could get.

In any case, these two key bits of advice were in hand at the DSS by December 18, 2014, some 12 days before Kathryn Campbell would brief Scott Morrison and 18 days before she would send her deputy and assistant secretaries scurrying to deliver briefs requested by the new minister.

What is not clear yet is whether the DSS ever sent the exact legal advice to its counterpart the DHS. Certainly, it was summarised for the DHS in plain language and made it into a February 12, 2015 executive minute prepared by Golightly and overseen by Campbell. This was the same brief that crowed about a potential new welfare crackdown on working-age payments (the usual targets: Newstart, the disability support pension, carers payments, single parents), which would “send an important message right across the country that ‘you’re next’ and there is very little chance to avoid being caught and punished”.

An original draft was only marginally more civilised: Golightly and Campbell had initially written that this message would signal to customers that “they could be next” but this was crossed out by Minister Marise Payne and replaced with the more grammatically direct “you’re next” warning. What matters is that the public service pre-empted what its political bosses would like, right down to the threatening tone of the brief, and came good on the promise to find those savings.

Although it was watered down somewhat, the February 2015 brief to Morrison remained firm on the need for legislative change. “The traditional compliance reviews are a manual, staff-intensive verification process involving obtaining information from customers and third parties often going back over a number of years,” the brief says.

“The ability to change the process is limited due to legislative and policy constraints on the need to apply income fortnightly to determine overpayments even if they occurred over several months or years and even if income data is only available on an annual basis.”

This month, on the stand, senior counsel assisting the royal commission Justin Greggery KC finally managed to get Campbell to agree to two things: the proposal in this brief fundamentally changed the way income was assessed, and the process pushed the investigative burden onto welfare recipients.

So, knowing all of this, Royal Commissioner Catherine Holmes asked: “On any aspect of this, did you look at the legislation?” Campbell was all at sea: “I can’t recall.” She argued it was the job of the DSS to get the legals – and they already had – and that the DHS was unable to seek its own clarification because of a minor administrative practice designed to prevent the doubling up of work. Campbell has a unique vantage point in this saga, however, because in September 2017 she moved from one of the departments in question to the other, becoming the secretary of the DSS. This was only a matter of months after the department had deliberately misled the Commonwealth Ombudsman about the legal basis of robodebt. Here we have a woman who was earning more than $800,000 a year – making her one of the highest paid officials in all of the Commonwealth – switching to the DSS and conceding on the stand that she thought all it had to do to make the scheme lawful at this point was to give customers an opportunity to provide evidence.

“I had in my time in human services focused on improvements to the system to meet what I understood to be the legal issue, which was [to] give recipients the opportunity to respond to the material, and, by September 2017, this was not the main issue I was focused on in social services,” she told the royal commission on November 11.

The man she replaced at social services, Finn Pratt, was adamant on the stand that this was a policy proposal born of, and delivered and completely overseen by, the DHS, and that this was “one headache which was not my headache”.

Things are complicated somewhat by the memory holes claimed by every official who has given evidence to the commission so far. Statistically, at least, it is unlikely that such a mass amnesia swept through the civil service regarding a single and highly controversial program. Serena Wilson, the person in charge of policy below Pratt at the DSS, destroyed all of her “personal” notebooks when she retired in 2017. These recorded things such as potential meetings and briefings with her boss, the secretary and ministers. But even if we allow that there was a lot going on (both Pratt and Campbell would like us to know just how big their departments were, and how they could never be across everything) and that not everything was memorable, the upshot of this is sickening. It means nobody stopped long enough to consider, even ethically, what the monster they had unleashed might do to the people at the other end. We tend to remember the times when we were conflicted.

Commissioner Holmes asked the pertinent question when Pratt, who signed a letter to the Commonwealth Ombudsman declaring robodebt was legal when his staff knew it was not, pleaded busyness.

“It was evident that whatever was going on was creating havoc for thousands and thousands of welfare recipients,” Holmes said. “It wasn’t an issue sufficient to attract your attention?”

The answer, of course, was “No”.

Campbell’s involvement is harder to explain away, given her close workshopping of the original brief to Morrison on February 12, 2015. What happened between that date and May when the budget measure was announced? How did a proposal that was clearly unlawful, and communicated as such, find its way into being? The royal commission has yet to come to that crucial three-month period in any detail, but it will.

What is already apparent, and has been named as such by Commissioner Holmes, is that there was some effort made, in both departments, to cover up the fact robodebt – known by various names internally – was started illegally and remained illegal.

In evidence, Greggery took Campbell to the annual reports signed off by her during her time as secretary of the Department of Human Services. In particular, he was interested in the 2016–17 report, which claimed: “The introduction of this online portal did not change how data matching was undertaken, or the way income was assessed and differences calculated.” In stark contrast, the brief Campbell had approved to Morrison in February 2015 was explicit that this was the key change under robodebt.

Greggery was at his most frustrated during the exchange that followed.

“You’ve given evidence here today that there were two significant changes in this system, which was introduced as a result of the proposal,” he said. “This represents there has been no change in process.”

Campbell conceded that the relevant line in her report may be “inaccurate”. “I do accept that this sentence is not optimal, that it could have been phrased differently,” she said.

Greggery snapped back: “It’s positively misleading!”

There are voluminous examples now of witnesses squirming on the stand under Greggery’s forensic questioning, all relating to multiple points on a five-year timeline when various officials knew or should have known that the various iterations of robodebt were fundamentally in breach of the law.

Proving what states of knowledge were inhabited by which key personnel at critical moments is the core mission here, and there are some big names still to testify.

Scott Britton and Jason Ryman, reporting to Mark Withnell in the Department of Human Services, are the architects of robodebt itself. The earliest reference to the idea that would become policy is in a June 30, 2014 minute prepared by Ryman and signed by Britton, who made a small revision: the information collected from the tax office, for example, wouldn’t necessarily affect income support entitlements. That was just a possibility.

Somehow, a possibility became a given.

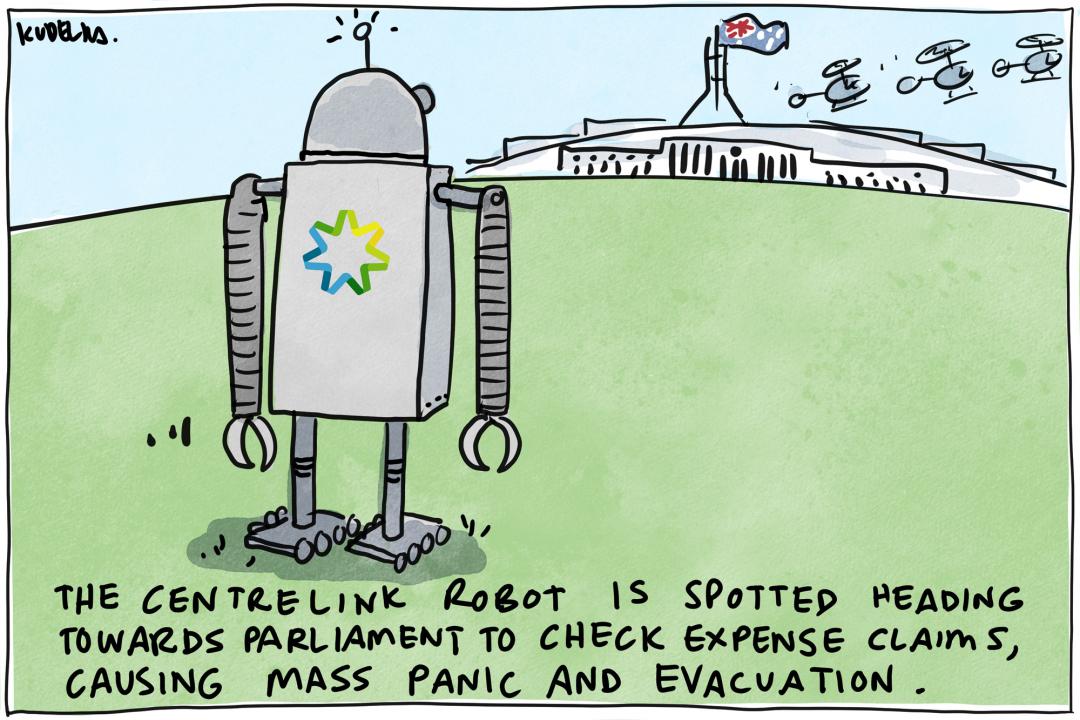

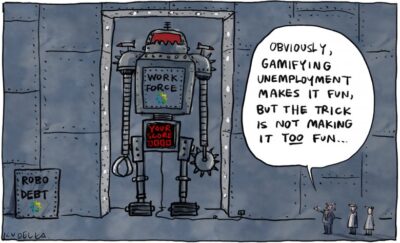

In a pilot phase, the robodebt program – being tested on just 1000 customers and still with some staff oversight – revealed that 58 per cent of people neither received nor responded to the Centrelink letter advising them of a debt. This was expected. A cynical proposition, Commissioner Holmes ventured, was that this was precisely what the department wanted: if a welfare recipient didn’t respond, the incorrect averaging of Pay-As-You-Go tax office data to fortnights was applied to the account. Debts were raised and debts were chased. People were told they could review the decision, of course, but if they did, they might not be able to prove an error and would be subsequently hit with a 10 per cent “debt recovery” fee. At first, the department’s notification letters didn’t even provide a phone number. This was no accident.

Ryman and Britton both recalled that the messaging and the language – down to the word – was developed with reference to the “science” of “behavioural insights”. That is, how to make people do what we want them to do. It’s common enough in marketing, but when there is a trick involved the practice is often referred to as deploying “dark patterns”.

At no point did either Ryman or Britton appear to consider what any of this might mean to someone who had been living in poverty, potentially with disabilities or with episodes of abysmal mental health.

What hasn’t been examined, and likely won’t be, is the cultural assumption, the ingrained belief, across much of Australia that people who are experiencing poverty or are otherwise disadvantaged are trying to take something from people who earned their good fortune. It’s a foundational myth of the colony, as it happens, that the underclass in England was agitated and looking to take life and property from the wealthier classes. This had to be dealt with. The solution – taking sovereign land on this continent to house the terror of the so-called criminal class – has never been much reckoned with. Never mind that robodebt was so obviously wrong that it would eventually cost the Commonwealth billions. Never mind that the machine would crush people as it was spun up full throttle.

Sometimes the cost of doing business – policing the poor – is worth it.

Sometimes the cost of doing business – policing the poor – is worth it.

In the February 2015 brief that went to Morrison, Golightly and Campbell noted that they wished to move more services online because this provided an opportunity to have welfare recipients “explicitly acknowledge that the information we hold about them is correct”.

“This will also state that the customer will be committing an offence by failing to adhere to these conditions,” it says. “This will support the ability to prove ‘intent’ in relation to fraud matters.”

The same brief also declared that the majority of payment error is driven by customer confusion about myriad payments, supplements and reporting rules that “can make it very difficult to comply with the rules, even when they want to do so”.

“A lot of your clientele would not be computer literate, wouldn’t have access to computers,” Commissioner Holmes said. “The most vulnerable layer of your customers would be the least likely to be able to deal with this, surely?”

Britton’s response was somehow the most galling, in a crowded field.

“Yes, no… that’s a good point,” he said.

Public servants, especially in Canberra, and especially the managers and senior executive service, live in their nice homes and they drive in their nice cars on wide open roads through suburbs nearly devoid of public transport. They park in their assigned spots at their sprawling offices – some of which are like mini-cities in themselves – and they do their work and make the same journey in reverse of an evening. In the Australian Capital Territory, which has one of the highest populations of disadvantaged people per capita in all of Australia, they just don’t come across the people on the fringes.

That’s no crime, though a lack of curiosity in the circumstances of designing a debt trap to ensnare those unfortunate down-and-outs raises important questions of administration and responsibility.

In June 2018, faced with a significant Administrative Appeals Tribunal case that could overturn the foundation of the robodebt cash cow, the DSS did what it had not done until that point: it went externally to the law firm Clayton Utz for advice. The lawyers’ “catastrophic” draft opinion made its way to senior bureaucrats on August 14. The Utz team offered to work with the language a little if necessary, but there was almost no room to move. Rather than finalise the advice, the DSS paid the invoice and hoped the matter would go away, like a “child putting its hand over its eyes” and pretending something didn’t exist, Commissioner Holmes said.

In June 2018, faced with a significant Administrative Appeals Tribunal case that could overturn the foundation of the robodebt cash cow, the DSS did what it had not done until that point: it went externally to the law firm Clayton Utz for advice. The lawyers’ “catastrophic” draft opinion made its way to senior bureaucrats on August 14. The Utz team offered to work with the language a little if necessary, but there was almost no room to move. Rather than finalise the advice, the DSS paid the invoice and hoped the matter would go away, like a “child putting its hand over its eyes” and pretending something didn’t exist, Commissioner Holmes said.

Little more than a month after that advice was received and ignored, Kathryn Campbell – who had now been secretary of the DSS for a year – took to the stage for the IPAA ACT event and lamented the absence of some naughty cricketers in the media. She made no mention of the legal challenges afoot.

Robodebt would continue its cruel and virtually autonomous abuse for more than a year after the audience politely chuckled at Campbell’s joke.

That’s just good manners, after all.

This article was originally published in The Monthly