New test for corporate accountability as Star found ‘unsuitable’ to hold casino licence

Will the NSW casino commission kill off Star's licence? Anything less will suggest big companies can simply evade consequences for misconduct.

Will the NSW Independent Casino Commission (NICC) take the historic opportunity afforded by the outcome of the Bell inquiry into Sydney’s Star casino, and kick Star out of the building?

Adam Bell SC’s report, released today, finds Star “presently unsuitable to be concerned in or associated with the management and operation of a casino in NSW”. The NICC has issued Star a “show cause” notice and will decide on its response once Star has responded.

Yesterday Christine Lacy in The Australian reported that while Star would be found by Bell to be unfit to hold a casino licence, it would be allowed to keep doing so subject to strict conditions.

If that turns out to be the case, it would be another example of what is emerging as a clear pattern of corporate evasion of the consequences of egregious misconduct — just as the pattern of the original misconduct was.

In recent years, two powerful and politically influential industries — finance and gambling — have been exposed as having engaged in conduct so extraordinary, and so poorly regulated, that royal commissions and major independent inquiries were needed to deal with it.

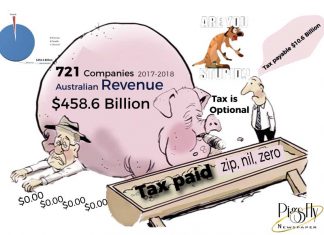

Both industries gave jobs to former politicians, senior bureaucrats and staffers, bought political favours with massive donations, and ran rings around regulators deliberately weakened by governments. Both flouted the law and common decency over many years in the name of profit.

But another pattern is now established in dealing with such conduct being exposed: dismiss some executives, a chair, some board members; profess to have learnt some lessons and to have put in place internal processes to ensure it never happens again. Then it will be back to business as usual. The companies concerned won’t face any serious threat; they’ll be allowed to continue operating, and no individual will face the courts and incur the risk of jail or a massive fine.

If Star is allowed to conditionally retain its licence, it will be because Star’s rival Crown got that treatment. Crown lost its Barangaroo licence but got it back relatively quickly, with conditions (in Melbourne — despite astonishing revelations of Crown’s links with organised crime, money laundering and tax dodging — it didn’t even lose its licence).

Remember that in both finance and gambling, major inquiries arose only because of the media’s assiduous work exposing misconduct and criminal behaviour, which resulted in enough political pressure that governments had to respond. The purported regulators had failed miserably in their jobs.

The NICC thus faces a major test. Will it break the pattern? Or will it continue to be the case that if you’re in a politically influential and generous industry, you need not fear fallout from even the gravest misconduct?

Individuals and small companies engaging in crimes in finance and gambling that investigations have exposed face dramatic repercussions: jail, massive fines, and getting kicked out of the industry. Money laundering for organised crime, enabling child abuse, entertaining organised crime figures, defrauding clients and misleading other financial institutions deserve nothing less. But large corporations in Australia escape consequences.

It illustrates how state capture not merely delivers policy and fiscal outcomes big companies want from governments, but also shields them from accountability when exploiting their power at the expense of the public interest.

State governments are just as vulnerable as the federal government — indeed, the relationship of Crown with the Victorian government under both sides of politics is the most obvious example of state capture in the country, more blatant than even the relationship between fossil fuel companies and the federal Coalition and Labor.

The NSW Independent Casino Commission should shut Star down; the licence can be placed on the market subject to punitive regulatory restrictions intended to prevent money laundering and links to organised crime. Anything less will be state capture.

This article first appeared in Crikey. Politics Editor @BernardKeane

Bernard Keane is Crikey’s political editor. Before that he was Crikey’s Canberra press gallery correspondent, covering politics, national security and economics.