Kenneth Hayne’s report into the banking and financial services industry makes 24 referrals to the regulators Asic and Apra to take action over misconduct.

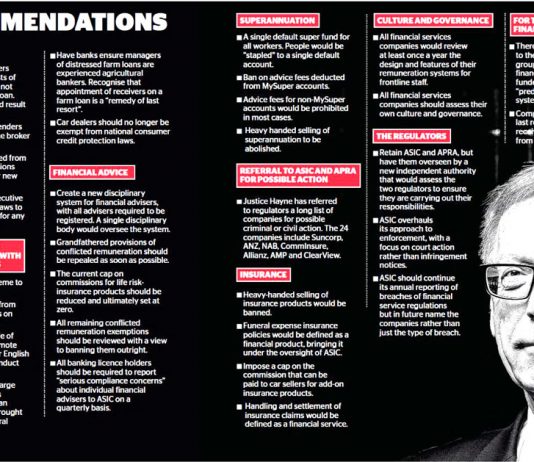

It also made 76 recommendations for how the problems can be fixed and contained scathing criticism of executives:

Key points:

- Bankers are not named and shamed, but Kenneth Hayne lays out the potential for more than 20 prosecutions involving the major banks, at the discretion of the regulators, some of which could be criminal, some civil, and some both.

- Of the 24 referrals for “further action”, all the major banks are listed, except Westpac.

- The regulators stay as they are, but are on notice to do better when it comes to enforcement. If Asic doesn’t pick up its game and prosecute more often, not just settle out of plain sight, there is room to make it just an investigative body and hand prosecuting powers to something else.

- The report points the way to an end to practices such as conflicted remuneration – you can’t advise for a client and get rewarded by a bank/financial service for providing that client at the same time, for instance. That seems like a pretty big no brainer, but it has taken a royal commission to get here.

- There will be a compensation scheme of last resort, funded by the banks. The government is working up legislation on that now. All the banks will have to pay, because it is part of their licence. For those who belonged to entities that have gone belly up, you’ll also be covered.

- Mortgage brokers will be required to act in the best interests of borrowers.

- Conflicts of interest between brokers and consumers will be removed by banning trail commissions and other inappropriate forms of lender-paid commissions on new loans from 1 July 2020. There will be a further review in three years on the implications of removing upfront commissions and moving to a borrower pays remuneration structure.

- Grandfathering of the conflicted remuneration provisions to be ended effective 1 January 2021 and, in addition to the commission’s recommendation, requiring that any grandfathered conflicted remuneration at this date be rebated to clients.

- Ensuring superannuation fund members only have one default account (for new members entering the system).

- Vulnerable consumers will be protected through clarifying and strengthening the unsolicited selling (antihawking) provisions, including for superannuation and insurance products.

- Deduction of any advice fees to be prohibited (other than intrafund advice) from MySuper accounts.

- Expansion of the definition of small business in the Banking Code.

- Comprehensive national scheme for farm debt mediation to be established.

- Elimination of default interest on loans in areas impacted by natural disasters.

- Appointment of receivers or any other form of external administrator only as a remedy of last resort.

- More inclusive practices for Aboriginal and Torres Strait Islander persons.