Everyone knows Australia’s big four banks are huge, accounting as they do for almost one quarter of the value of all the companies on the entire ASX.

But they are actually even bigger than they seem, thanks to a network of other brands and subsidiaries that often carry no obvious sign that they belong to a big bank.

This is part of a controversial practice known as ‘vertical integration’, which sees single companies controlling several links in the supply chain. It’s a practice fraught with potential conflicts of interest, and the big banks absolutely love it.

A prime example of vertical integration – NAB’s deal with realestate.com.au to sell ‘white labelled’ (ie disguised) home loans through the property website.

But there are many, many more such examples of vertical integration. This rifeness combined with the potential conflicts means it will surely be a major focus of the banking royal commission.

So with the first royal commission grilling just a few days away, we thought we’d clarify which brands belong to which banks – just in case you haven’t picked it up yourself.

Most consumers will be familiar with the three smaller banks, St George, Bank of Melbourne and BankSA.

But what they may not realise is that, first, they are wholly owned by Westpac, and second, they are literally the same bank, just branded differently so as not alienate the local clientele.

Of the non-banks in the Westpac family, BT Financial Group is probably the most important. It specialises in superannuation, investments, insurance and financial advice.

Asgard is what is called an investment ‘platform’ – basically an online investment supermarket. It’s used by (probably Westpac-aligned) financial advisers to invest their clients’ money, often in BT’s investment products.

Uno, meanwhile, is an online mortgage broker. In the company’s “about us” section, it laments the “lack of transparency” in the mortgage broking market.

Ironically there is almost no sign on the website that Uno is majority-owned by major mortgage lender Westpac.

Hastings, meanwhile, is a major infrastructure investor that invests huge sums of money on behalf of superannuation funds.

We’ve already talked about UBank and realestate.com.au Home Loan in the previous article, so let’s start with MLC.

MLC is NAB’s answer to BT – a superannuation, investment and financial advice company.

Plum is part of MLC, and specifically provides default workplace superannuation products. It sells super to employers, who then default their employees into the fund if those employees fail to nominate their own fund.

JBWere is a ‘wealth manager’ – i.e. a high-class financial adviser that manages money for the very rich.

Advantedge is a company that builds ‘white label’ home loans for companies like realestate.com.au who want to offer home loans, but don’t have the licence, capital or expertise to do so..

Commonwealth Bank of Australia has owned Perth-based bank Bankwest outright since 2008, when it bought it off global banking giant HBOS. If you bank with Bankwest, you bank with CBA.

Colonial First State is CBA’s answer to MLC and BT – a superannuation and investment company.

Importantly, CBA has said it wants to sell the investment management part of this business, Colonial First State Asset Management. This is a definite move away from vertical integration. Westpac is moving in the same direction, having sold off the vast majority of BT Investment Management (a separate business from BT Financial Group).

Despite carrying no CBA branding, colourful businessman ‘Aussie John’ Symond’s Aussie Home Loans is 100 per cent owned by Australia’s biggest bank.

Finally, Count is a company that combines accountancy services with financial advice.

Which brings us on to a subject that would need an article all of its own. Australia’s big four banks plus AMP control well over 80 per cent of Australia’s financial advisers.

Much of the time, though, you would have no idea because the advisers appear to be independent small businesses.

And Finally…..

ANZ’s only subsidiary of note that is not ANZ-branded appears to be OnePath, a wealth business like BT and Colonial First State, which ANZ is in the process of splitting up and selling off to IOOF and Zurich.

This lack of separately branded subsidiaries makes ANZ by far the most transparent of the big four.

This article originally appeared in the New Daily

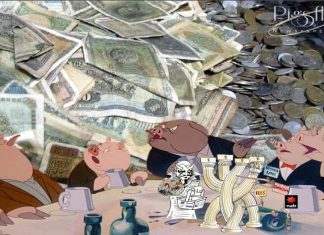

For the past two years ASIC has been reviewing the vertically integrated business models that the big four banks and AMP use in their financial advice arms to flog customers inhouse bank products. The regulator wanted to see whether the models served customers or just financial institutions.

A report on ASIC’s review released in January found 75 per cent of advice files reviewed did not demonstrate compliance with the duty to act in the best interest of clients. Of that, 10 per cent were found to have contained advice that would have left the customer significantly worse off.

Responding to Senator Hume’s hope industry super would be included in the ASIC review, Industry Super Australia chief executive David Whiteley said: “The banks selling of super and other financial products through financial planners and other staff seems driven by profit rather than providing consumers with impartial financial advice.”