On a recent snowy afternoon in Ottawa, Jean-Yves Duclos sat in his as-yet-undecorated office overlooking Canada’s Parliament, reflecting on the limits of government. Until last fall, Duclos was an economics professor specializing in the use of public policy to reduce inequality. In November, he became the country’s minister of families, children and social development; his new job is to execute some of what he previously theorized about. But very, very carefully.

“Trade, globalization, technology — all of that has over the last decades favored in larger part the top earners,” said Duclos, whose relaxed air, careful choice of words and surprisingly large pink boutonniere were simultaneously charming and vaguely patrician. “And that we can address in limited manners if you want to make sure that you’re not hindering growth.”

Duclos has an assignment that progressive politicians in the U.S. can only dream of: Reduce inequality without regard to partisan politics — or fear of deficits. Because Canada’s new Liberal government won a majority of seats in October’s elections, it can pass legislation over the objection of opposition parties. This gives the party something like free rein to implement two promises central to its election campaign: reversing the decline of Canada’s middle class, and stimulating the economy by running deficits. Big ones. For at least three years.

Canada is about to embark on an experiment whose outcome ought to matter deeply to U.S. Democrats and Republicans alike as they consider how to respond to Donald Trump’s angry coalition of the downwardly mobile. At issue is this: How far can a market-oriented country, if it were temporarily freed from short-term concerns about politics and budget deficits, push the fight against inequality — without sparking public alienation, a decline in work, a rash of tax avoidance, an exodus of talent or wealth, or some other unpleasant consequence?

In other words, what are the practical limits of the inequality agenda? And how much can be done within those limits to satisfy, or at least mollify, the furies of economic insecurity?

Canada is perhaps the ideal setting for that experiment. Despite its image as a North American outpost of Scandinavian social values, the country has experienced a divergence in high and middle incomes similar to the U.S.’s, if not quite as severe. Unlike the U.S., Canada has already done the obvious things to remedy that: Its residents enjoy universal health care, reasonably generous social programs, paid family leave, a relatively high minimum wage, and college tuition that averages less than $5,000 a year. Yet that hasn’t been enough to reverse the trend (interrupted by the recession) toward ever-greater inequality. So the lingering question for progressives in both countries is this: What more is there to do?

The short answer: quite a bit. In December, the Liberal government increased the tax rate on income above Canadian $200,000 ($150,800) and cut taxes on the middle class. The Liberals have said their budget, to be introduced later this month, will introduce benefits to low- and middle-income families of C$6,400 a year ($4,825) for each child under 6, and slightly less for children ages 6 to 17. They also promise to reduce contribution limits for tax-free savings accounts and prevent single-income couples from splitting that income for tax purposes, reversing policies that disproportionately benefit the wealthy; increase monthly payments to low-income seniors (think of top-up payments to Social Security); fund the construction of more affordable housing; and make it easier for workers to form unions. In case that’s not enough, Prime Minster Justin Trudeau has asked Duclos to develop a national poverty-reduction strategy. Duclos has even mused publicly about introducing a guaranteed minimum income.

Most progressive parties — not least the Democrats, some of whose advisors the Liberals relied upon to help craft their message, and who will aspire to a similar agenda if Hillary Clinton becomes president — would be thrilled to enact even a portion of what Canada is about to do. Duclos describes his mandate in sweeping terms. “We have programs and measures and ambitions that span across a whole lifetime of individuals and families,” he said.

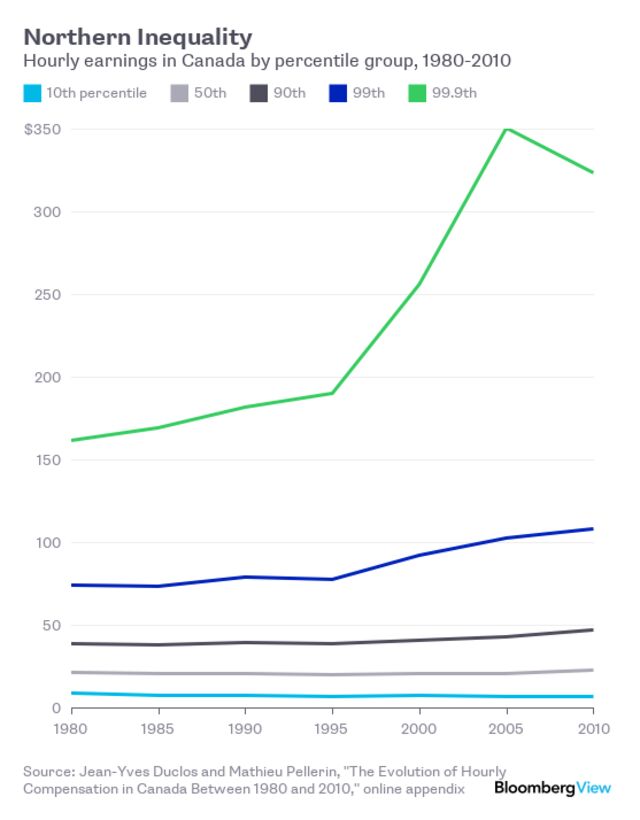

But just as telling as what Canada is doing is what it’s not. A few months before he was elected to Parliament, Duclos published a paper arguing that the increase in inequality in Canada between 1980 and 2010 mainly reflected the rising earnings of the top 0.1 percent. Yet the new tax rate for high-earners will reduce their after-tax earnings by an average of C$5,255 ($3,960) in 2016 — which would be no small amount for the typical household but is not enough to change the trajectory of wage growth at the very top.

But just as telling as what Canada is doing is what it’s not. A few months before he was elected to Parliament, Duclos published a paper arguing that the increase in inequality in Canada between 1980 and 2010 mainly reflected the rising earnings of the top 0.1 percent. Yet the new tax rate for high-earners will reduce their after-tax earnings by an average of C$5,255 ($3,960) in 2016 — which would be no small amount for the typical household but is not enough to change the trajectory of wage growth at the very top.

Duclos’ rationale for not pushing harder was eminently rational: The rich might leave. “All tax policies, all transfer policies, have an impact on behavior,” he said. “In a world of increasing income flows, labor migration, capital flows, it’s always important to think about the evasion, the movement opportunities that higher-income individuals have. In the vast majority of cases, these opportunities are perfectly legal, and therefore are not objectionable. But we need to be conscious of it.”

In turn, the practical barrier to further increasing the tax burden on wealthy households limited the size of the tax cut the Liberals gave to the middle class, which was meant to be paid for through the new taxes on the rich. The party trumpeted that December tax cut — which reduced the income tax on earnings between C$45,000 and C$90,000 ($33,900 to $67,800) to 20.5 percent, down from 22 percent — as a salve for stagnant wages. But an analysis found that only those in the top 30 percent of earners will benefit, and not by much: Those between the 70th and 80th income percentiles, for example, will save an average of just C$26 ($19.60) a year. (The report found that even this small benefit would cost C$1.7 billion — $1.3 billion — more each year than the projected revenue raised by the new tax on the wealthy.)

Another sign of the limits of fighting inequality is the government’s insistence that the chief beneficiary of that fight will be the middle class — as opposed to the poor, who have seen the gap between themselves and the richest households grow much more. While this may seem like harmless political rhetoric designed to appeal to as many voters as possible, living up to it appears to have produced policy designs that wouldn’t otherwise make much sense.

For example, the government’s promised child tax benefit would result in more new money for households earning C$90,000 a year than for those making just C$15,000 ($11,300), according to one report. And reducing the taxes paid on the first C$45,000 of taxable income, rather than on income between C$45,000 and C$90,000, would have done a far better job of helping the actual middle of the income distribution. (Even the right-leaning Conservative Party has noted the Liberals’ relative lack of support for the poor. “So far this government has not addressed anything for low-income families,” Karen Vecchio, the Conservatives’ critic for social development, told me.)

There is a final constraint on what Canada’s government can undertake: Free trade can be criticized in its particulars, but it can’t be rolled back. In his paper last year, Duclos wrote that after controlling for education and experience, wages had stagnated since 1980, which he attributed to “deeper macroeconomic trends.” One of those trends is the ever-growing exposure of workers to foreign competition. Yet the Liberal government, in addition to promising better living standards for the middle class, is also pursuing trade deals with Asia (through the Trans-Pacific Partnership) and the European Union.

Even if they magically regained control of Congress this November, Democrats would likely find themselves bound by these same constraints. Any changes to the tax code that cause the rich to live elsewhere are unlikely to make the country better off, regardless of their effect on inequality. If voters will only support new transfer programs or tax breaks that disproportionately benefit the middle class, that’s their right. And trade protectionism, even if it props up the earnings of some lucky groups, hurts consumers and holds back innovation; it amounts to an opaque and especially costly kind of charity.

This leads to the most interesting question about what Canada is attempting, and the one that should most worry Democrats and Republicans: What if returning income inequality to its level of 20 or 30 years ago is impossible, as much as voters may demand it — not because of partisan obstructionism or short-term budget constraints, and not because (as Trump argues) government officials are incompetent, but because the degree of economic engineering required is fundamentally incompatible with what an open society is willing to accept?

This is not an implausible position, and it invites a more generous definition of victory in the campaign against inequality. If the goal isn’t to collapse the trajectories of income back to where they once were, but only to give more people a shot at the upper vectors and ease the discomfort of everyone else, maybe Canada will become a model to follow.

Indeed, Duclos argued that success in reducing income inequality shouldn’t be measured by income alone. “It’s not the outcome in terms only of living standards,” he said. “It’s also the behavior of people,” defined by more people looking for work, more social inclusion or even better health.

Critics may respond that the broader the categories of measurement become, the easier it will be for Canada’s government to rate its efforts a success. This is accurate, but not quite the point. The debate over inequality rests on the implicit premise that if governments would just make the right choices, middle-class households in Canada and the U.S. could once again see their standards of living rise from one generation to the next. That might not be true, either because other countries’ workers will still work for less, or because the sources of rising living standards have been exhausted, or because robots are taking over menial (and not-so-menial) jobs, or simply because the jar of magic pixie dust that defined the last 70 years of life in North America is finally empty.

And if the dream of a constantly rising living standard for the middle class no longer holds, then a government’s job is to search for more creative ways to make whatever new reality emerges less arbitrary, or at least less unpleasant. That is not quite the promise Canada’s Liberals ran on, but it could be their great achievement — and it could help define the limits of what future U.S. governments can hope to achieve as well. Whether that’s enough to satisfy the anxieties of the middle class is another question.

Originally published by Christopher Flavelle, Bloomberg View, March 7, 2016