Tax rorters tables - below

Alan Joyce CEO of Qantas has a take home salary of A$24,500,000 which turns out to be more than double the $10,955,067 tax Qantas begrudgingly paid to Australia. Effectively taxpayers have underwritten – kicked the can – subsidised Alan Joyce’s take home pay to the tune of $13million. And we are not even going to mention the $1billion grants and subsidies thrown Qantas way after it tossed 30,000 workers on the trash heap.

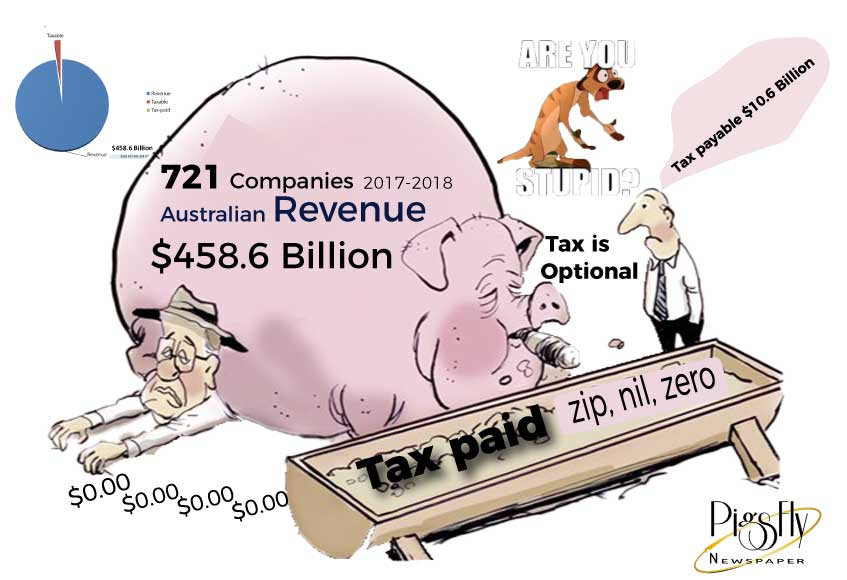

Company tax optional

About one third of large companies have once again failed to pay a cent of tax, according to the Tax Office’s latest corporate tax transparency report released on Thursday.

Tax avoidance or tax rorts?

More than one third of Australian companies have again failed to contribute to Australia

Grovelling governments keep falling over themselves in eagerness to please their masters. What’s required is endless tax cuts and corporate welfare for the rich, either deliberately unfunded or partially funded by slashing social welfare and public program funding for everyone else.

Masters of spin. Company tax breaks, company incentives

NEOLIBERALISM IS an abomination of a term. For a start, there is nothing “new” or “liberal” about neoliberalism. It is a chimera or a chameleon, changing all the time, depending on the situation, morphing but not new. It is about much more than economics. It is an ideological belief system built around elitism and a perceived “natural order” of things, in which the 0.1% should own everything.

There is a wealth of literature and evidence, deep and wide, on many aspects of neoliberalism. How its fanciful, juvenile high principles and ideological constructs are often jettisoned in staggering hypercritical backflips and necessary “exceptions” to the rules when there’s a quid or two more to be trousered by the 1%, or some banks to be saved to pursue even more greed.

Exxon the biggest of the US oil majors, this corporation has been making fabulous profits in Australia for fifty years, yet has never paid income tax

Tax rorters tables - below

Many companies have claimed tax losses and concessions that often go back several years.

There were 1,504 corporate entities in the 2017–18 data that reported tax payable of $52.3 billion — a net increase of $6.6 billion from the previous year.

The ATO’s report noted the increase was primarily driven by the mining, energy and water segment, off the back of strong commodity prices, which were up 15 per cent in Australian dollar terms in 2017–18.

ATO deputy commissioner Rebecca Saint said groups that consistently reported losses or unusually low taxable incomes were more likely to attract the ATO’s attention.

She told ABC News there were still instances of outright tax avoidance, in which multinationals attempted to shift profits outside of Australia to reduce their local taxable income, and these often resulted in the ATO’s Tax Avoidance Taskforce specialist teams undertaking audits.

“The positive trend we are now observing is that many companies have ceased generating accounting losses, and are now offsetting profits by utilising losses from prior years,” Ms Saint said.

“We expect many companies to exhaust these losses and begin paying income tax in the coming years,” she added.

The financial reports often give limited insight into a company’s Australian operations, and Mr Hirschhorn has called on companies to be far more transparent, including by providing more details about money flowing offshore to related entities in financial and/or other reports.

The ATO notes several limitations in its data. First, the 2,214 corporate tax entities are not necessarily standalone entities and are sometimes part of a group of entities.

“The majority of economic groups in the corporate transparency population have linked entities outside the scope of this measure,” the report said.

About 72 per cent of Australian private entities in the transparency population are linked to groups controlled by wealthy individuals, including high-wealth individuals.

The groups consist of close to 11,000 linked entities, including companies, trusts, partnerships and superannuation funds.

The ATO report said confidentiality provisions prevented the agency disclosing certain information about them.

“This means we cannot include details of the income and tax paid by other related entities,” the report said.

GetUp Campaigns Director Ed Miller said the tax system needed to be overhauled.

Tax rorters tables - below

ATO says it takes ‘strong action’ against tax avoidance

Ms Saint said laws passed by the Federal Government were helping the ATO take “strong action”.

She said more than $7 billion of sales income was now being booked in Australia as a result of companies, including Facebook and Google, restructuring in response to the Federal Government’s tougher anti-avoidance laws, including the Multinational Anti-Avoidance Law (MAAL).

Of the 2,214 corporate entities covered in the data, 1,197 are foreign-owned companies with an income of $100 million or more.

Of the 1,017 Australian public or private entities, 594 have an income of $100 million or more, and 423 have an income of $200 million or more.

Corporate entities with an income of more than $5 billion represent only 2 per cent of the corporate transparency population but are liable for 53 per cent ($27.9 billion) of the tax payable for the population.

This share of tax payable decreased slightly from 57 per cent in the previous year, the ATO report said.

Why companies did not pay any tax

The proportion of entities with nil tax payable has fallen over the past three years, from 36 per cent in 2015-16 to 34 per cent in 2016-17 and 32 per cent in 2017-18.

“We look at the tax positions of these [large] companies very, very closely,” Ms Saint said.

“And we have observed that companies can and do make losses as part of usual business practices.”

The reasons why 710 companies did not pay any tax in 2017-18 included:

- 269 entities that reported a taxable income but prior-year losses were available to deduct against that profit, so no tax was payable

- 242 entities reported an accounting loss

- 146 entities reported an accounting profit but reconciliation items (such as tax deductions allowed at higher rates than accounting permits) resulted in a tax loss

- 53 entities reported a taxable income but were also entitled to offsets (such as the research and development tax incentive) at least equal to the tax otherwise payable

Tax rorters tables - below

Read who are the greedy, the unprincipled companies that once again decide Australian company tax is optional. COAL, GAS, LPG, OIL, ENERGY, AIRLINES

Whitehaven, Glencore, Exxon, Santos, Claremont Coal, Peabody, Puma Energy, Shell Energy, Stockland, Westfield, Toll, Virgin, Wilson parking, the list is endless. You decide if they deserve your custom.

They have paid zip, nil, na na, nothing for the privilege of creating wealth for themselves while firmly deciding that they have no intention of contributing to Australia.

Full List below

Discover which companies paid what tax, if any

Or is it more like a pittance of tax 2017-2018, according to the Tax Office’s latest corporate tax transparency report released on Thursday

Full List below

The politically connected and political donors

Almost 1,500 companies, controlled by rich Australians including Perth media billionaire Kerry Stokes, Melbourne packaging clan the Pratts and Sydney’s Belgiorno-Nettis family, are exempt from laws that require other large enterprises to file financial records that are available to the public.

For those who want to keep the loophole alive, it’s a valuable privacy measure that helps allay the fears some rich Australians have for their personal safety and let them get on with life outside of the limelight.

For those who want to keep the loophole alive, it’s a valuable privacy measure that helps allay the fears some rich Australians have for their personal safety and let them get on with life outside of the limelight.

But to Labor’s shadow assistant treasurer, Andrew Leigh, it is, he told parliament during the week, a “cloak of invisibility” for government mates.

On each of the four sitting days this week he moved a motion to shut down the loophole. Each time, the government voted it down without debate.